EU Dynamism: Part I

Acknowledging the EU's competitiveness gap

EU Dynamism: Part I

This is the first of two parts about unlocking the European Union’s dynamism.

Part I: Acknowledging the EU’s competitiveness gap

The first part will help us understand the problem. The second part might contain the solution, part of which we are already witnessing today. Let’s dive straight in.

Acknowledging the EU’s competitiveness gap

Six months ago, Mario Draghi released a bombshell report about the current state and future of the European Union. In the so called “Draghi report”, the well-respected former President of the ECB and ex-PM of Italy laid out in very simple terms the lack of competitiveness that threatened the longevity of the European Union.

If you haven’t read the report yet, it’s worth doing so. It is a deeply-researched gem about how the EU is falling behind two other geopolitical giants, the US and China.

After reading carefully the Draghi report, I decided I want to understand this growing competitiveness gap a bit better. Given the recent Trump election and the new President’s focus in re-evaluating the relationship between the two long-standing allies, I will be looking primarily on how the EU compares to the US.

What follows is a deep-dive comparison between EU and US on four key areas:

Economic value and growth

Scale and performance

Investment in innovation

Large results

Why these four? Because I think the GDP gap, size/productivity, innovation intensity and actual outcomes form the basis of understanding why the EU is trailing the US.

This will be a chart-heavy article, so buckle up.

1. Economic value and growth

In the past 50 years, GDP growth in the EU has been much slower than in the US.

EU GDP fell from 120% of US GDP in 1992 to just 66% of US GDP in 2022. From producing a higher total economic value, the EU has now a fraction of that in the US.

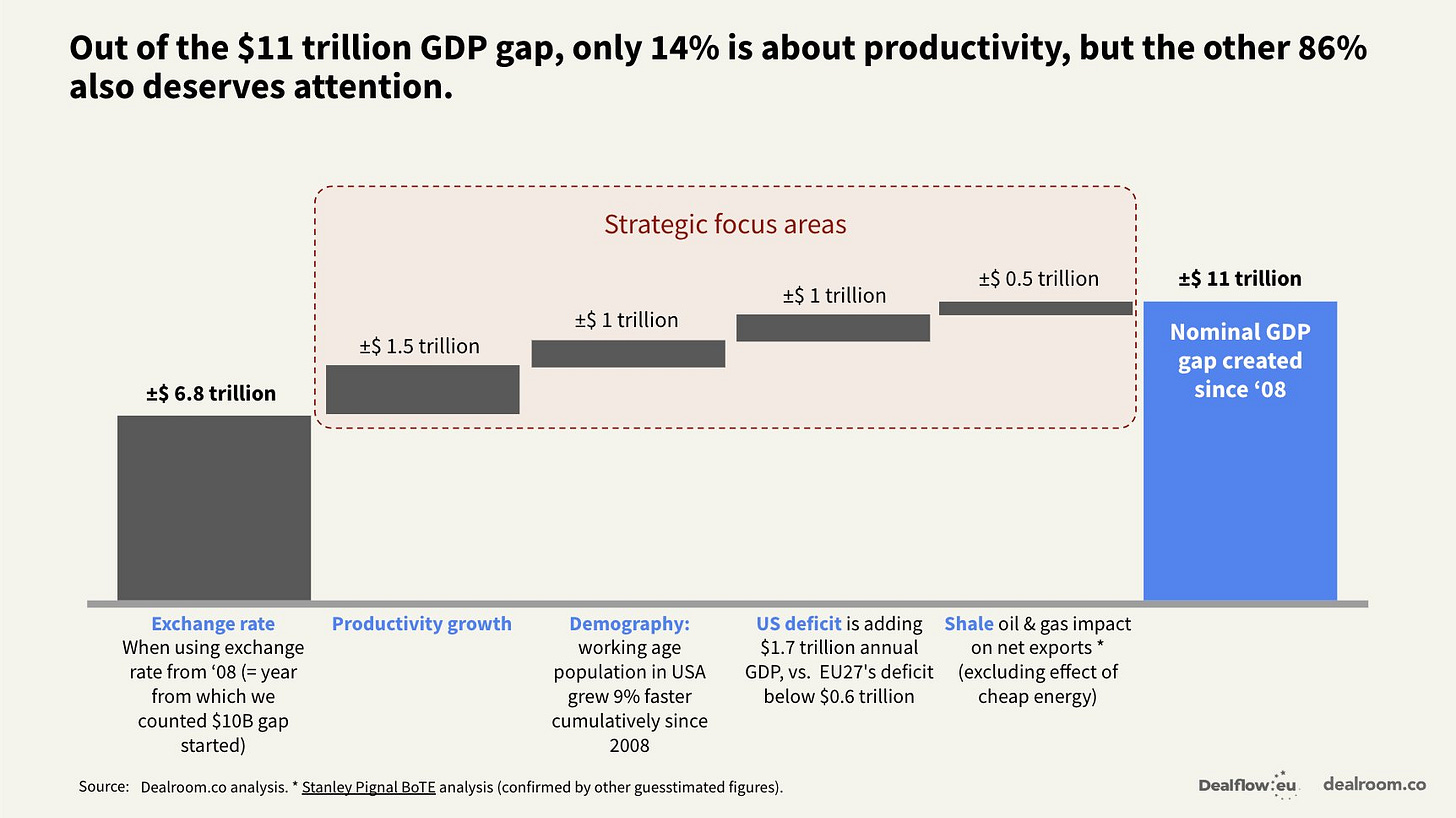

The slower pace of growth in the EU has led to a $11 trillion dollar gap with the US.

2. Scale and performance

Europe has been far behind in terms of corporate size and efficiency against the US.

The EU has 50% fewer companies with a market valuation below $500 million than the United States. It also has far fewer companies with higher valuations.

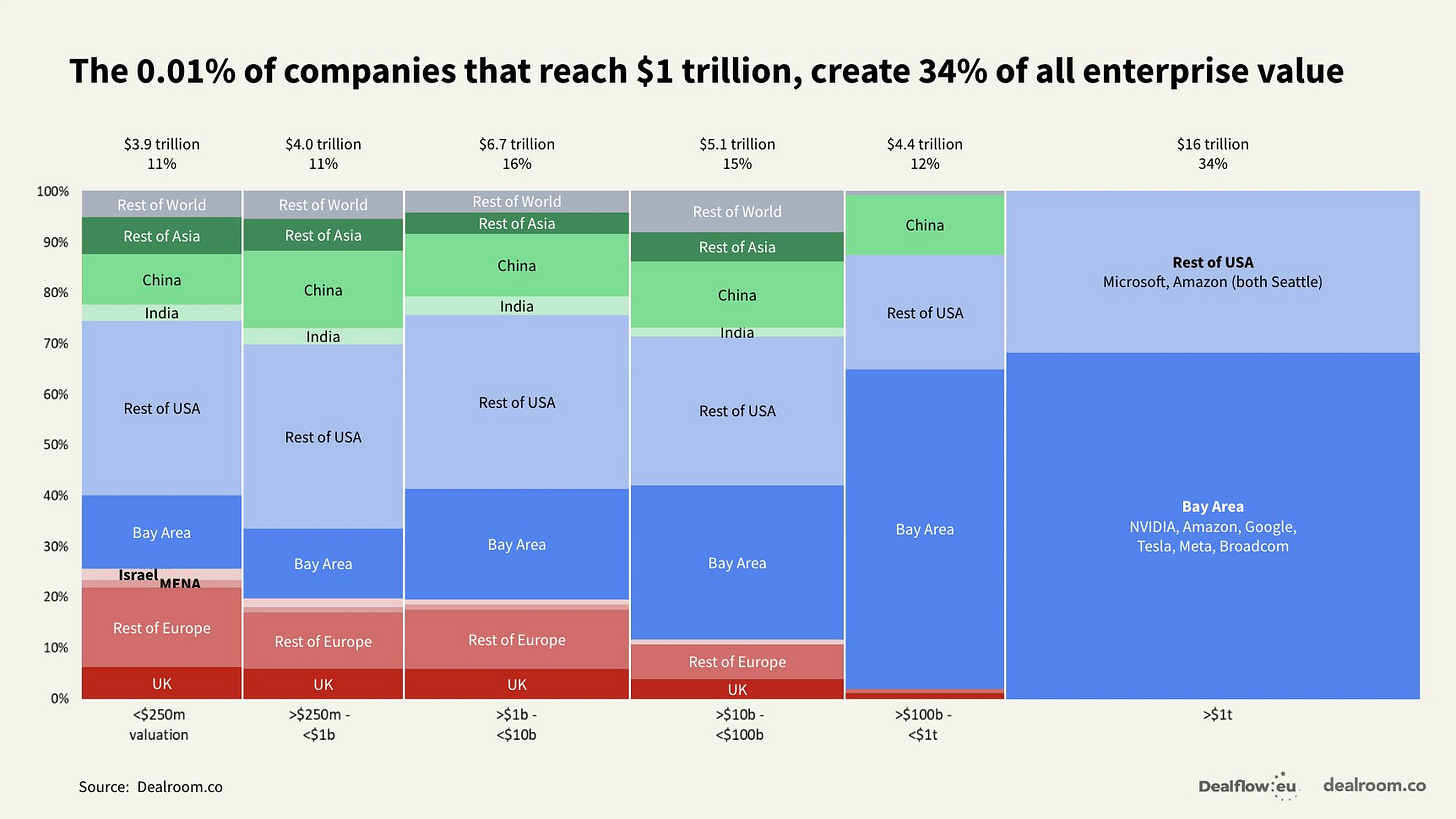

The 0.01% of companies that reach $1 trillion create 34% of all enterprise value. The US dominates here, with the Bay Area leading the way. The EU has none.

In 1990, labour productivity in US and EU regions was very similar. Each worker’s annual output averaged about $53 per hour. Since then, a large gap has emerged, with US labour productivity now about $14 higher than EU.

European productivity, especially in the tech sector, has lagged far behind the US.

Higher productivity growth accounts for about 14% of the $11 trillion GDP gap between the EU and US.

3. Investment in innovation

EU has been consistently spending less than the US on R&D. In 1991, US expenditure for R&D was 40% larger than the EU. In 2021, that difference was up to 77%.

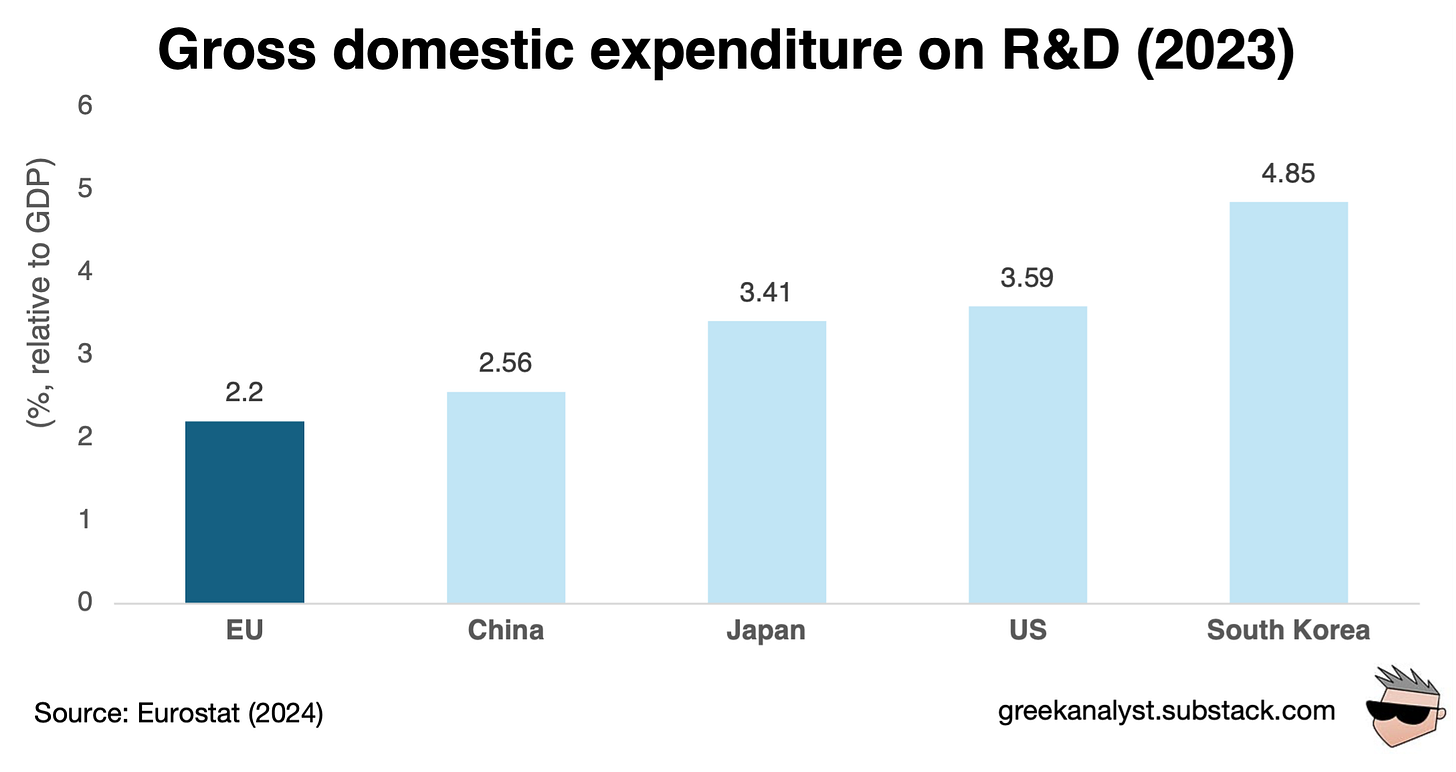

EU has been spending less on R&D as a percentage of GDP than China, Japan, US and South Korea.

EU VC investment in tech has been consistently lower both against the US and China.

US venture capital (VC) investment is significantly higher than in the EU across all startup development stages (seed, early stage, later stage).

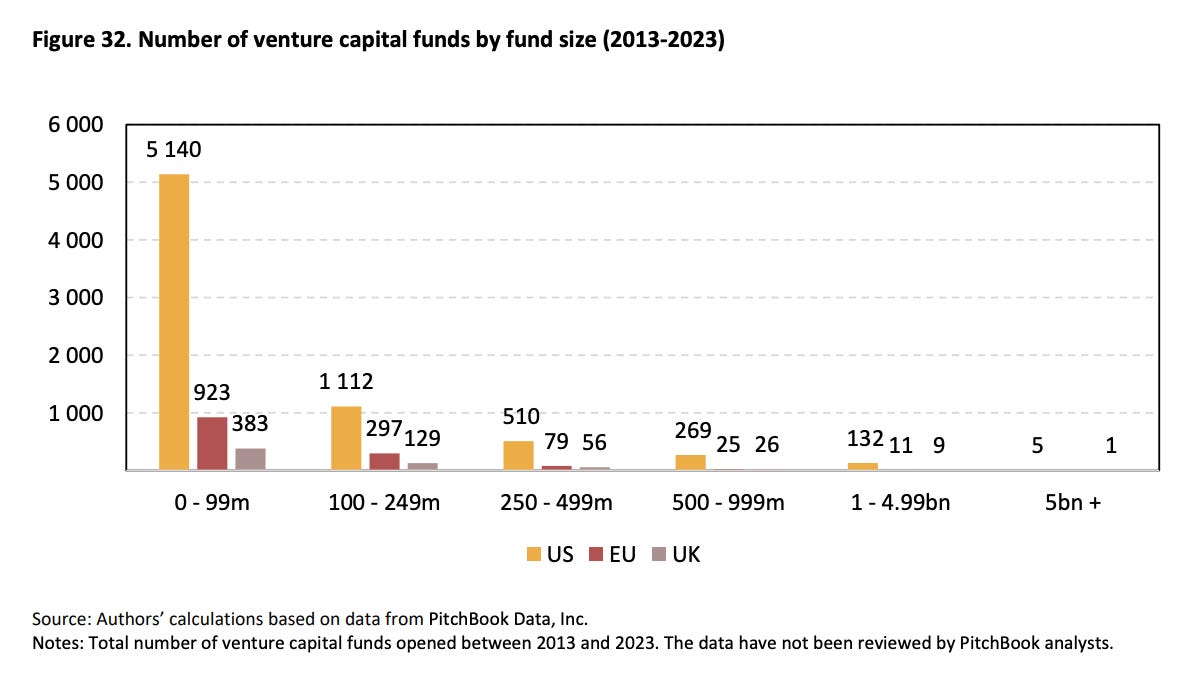

The US has significantly more VC funds than the EU across every fund size category.

Ten years after their establishment, EU scale-ups have raised on average 50% less capital than their US counterparts.

Large European companies (with above $1 billion in revenue) invest significantly less in technology than their counterparts in the United States.

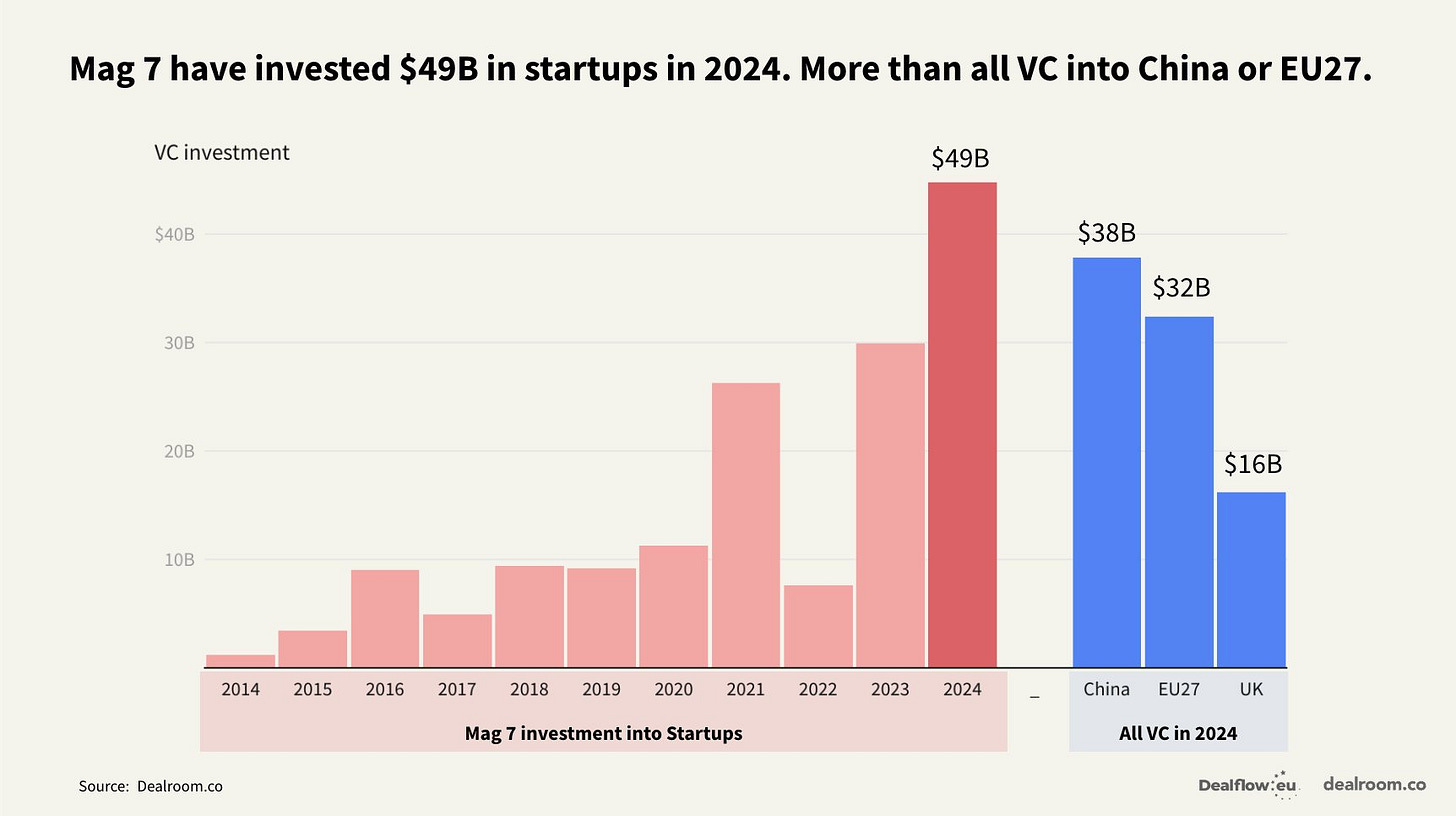

The Magnificent Seven (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla) invested $49 billion in startups last year. The entire EU invested $32 billion.

The share of EU firms among the top global R&D investors has been falling since 2010. In contrast, it has been growing consistently in countries like the US and China.

Europe is the undisputed leader in only a handful of key technology domains.

4. Large results

55% of all unicorns (ex and current) in the world are located in the US. The EU only boasts about 8%.

(Note: A unicorn is a startup company valued at or above $1 billion.)

Across the EU, there are about 300 unicorns today (both ex and current). The majority of them are located in four countries: Germany, France, Sweden and the Netherlands.

Only 15 European countries can boast at least one billion-dollar exit in their history. Almost half of the European exits during the past decade have taken place in the UK, including the two most valuable ones (IHS Markit, ARM). The rest are spread across the EU as seen below.

What if we go a bit deeper, and look at the biggest results in the past 50 years?

EU has 14 “from-scratch” public companies that have ever grown to more than $10 billion in market cap. That’s just 14 companies in 50 years. Do you know how many the US has? 241. That’s a 17x more.

(Note: “From scratch” here means a company that has been started from inception without going through M&A or being a spinoff from other firms.)

While the US market is led by the unprecedented rise of the Magnificent Seven over the past few years, there are 80 more US tech companies pushing the number up.

The EU’s 14 companies come from just 7 EU countries: Sweden (5), Germany (2), Denmark (2), Ireland (2), Netherlands (1), Belgium (1) and Spain (1). Less than half of these companies are in tech (6 out of 14).

If you want to read more about these high-value companies, I highly urge you to read this piece by Andrew Mcfee, whose research was used for the graph and table above.

Is all hope lost for the EU?

Did you read this far and believe that the EU is doomed? Well I have news for you!

The gap is big. It is real. And it is indisputable. In fact, the gap is so glaring that it has become impossible for anyone (including my beloved EU bureaucrats in Brussels) to try and deny it in any way. This is the first time in decades that the EU is finally taking its slump seriously, talking about it publicly with high urgency, and starting to develop the path towards addressing it.

This does not just include top European leaders, such as European Commission President Ursula Von der Leyen, who named the Commission’s plan for the next 5 years as Competitiveness Compass. It also includes grassroots movements, such as European Accelerationism (eu/acc), which aims to remove friction across the EU and enable rapid technological and economical growth, while keeping our values intact.

Yes, there are many caveats here: Von der Leyen’s plan might fall short of the level of ambition Europe requires right now, or it could just be a show to save face after a questionable previous tenure. Also, the eu/acc movement might be so enamored with the Silicon Valley style of techno-utopianism that it might too become blind to the social, political and economic considerations that are required for long-term sustainable growth. And yet, I really think that all this does really not matter.

For all the doom and gloom that the cynics typically spread, there is an expanding group of people who believe in the EU and are pushing for ways to accelerate European innovation. In fact, I’ve never seen so many people publicly speak up about the potential of this continent and how we must finally raise the stakes — and our set of expectations — about what the EU can do.

This is what I wrote four years ago, back in 2021:

For all its follies and Eurocratic inertia, Europe is also progressively becoming a land of ever-increasing opportunities. Some might only see a slow-running and heavily-lobbied gerontocracy based out of Brussels (and Berlin) heading a swath of low-growth, tech-deprived economies. And, sure, there might be some truth to this caricature; but that would only be one small part of a much greater, richer picture.

Europe is experiencing a quiet, but incontestable tech renaissance. European startups are killing it and established players have proven themselves at a global level. This has led to major exits, the creation of close to 100 unicorns, unprecedented investing appetite (led by US VCs who are now building entire offices in Europe, after operating mostly on stealth-mode until now) and the infusion of a newly-found risk-taking tolerance cultivated by hungry startup mafias and successful serial entrepreneurs.

We are entering a golden age for European (and Greek) tech. I am super eager to see where it takes us. Buckle up. The road might get bumpy, but the trip will definitely be worth it.

I wouldn’t change a single word today.

In Part 2 of this series, I will explain how the EU can still turn things around (and seems to have already started to).

That’s it for today! If you enjoyed today’s newsletter, please let me know with a like or reply. And if you value the content shared here every week, consider pledging your support. Thanks!

On fire these days.

Thank you for another interesting read.

I went ahead to submit my proposal : https://ideasandbugs.com/p/the-imperative-of-financial-democratisation-in-europe

I hope we see more action and less talking. I will do my best to participate as well.