Welcome to the 30 awesome new readers who joined us in the past week!

If you haven’t subscribed, join 3,119 smart, curious people interested in Changing Greece.

🎰 Greece’s gambling epidemic

Two days ago, my favorite Greek financial writer Sofokleous Street published a great piece on the gambling mentality so prevalent in the country. If you haven’t read it yet, it’s definitely a must read.

Greeks gambled more than €15.6 billion in ‘lucky games’ during 2024.

Compare that to the total revenue produced by the large local tourism industry, which stood at €21.7 billion for the same year. (For context, the entire legal sportsbook in the US was €143 billion worth of bets — that’s just 10x for a country 34x Greece’s size.)

Unfortunately, there is no way to sugarcoat reality.

Greeks are addicted to betting. And Greece is experiencing a gambling epidemic.

This is not a Greek-specific problem. Gambling is a global threat to public health. According to the WHO, 1.2% of the world’s adult population is addicted to gambling. But Greece — vulnerable after the crisis, with few options to save/invest easily and almost no safeguards for minors — is especially prone to this problem.

Adolescents are particularly susceptible to online betting addiction: out of the universe of all Greek bettors, 40% of ages 17-24 bet online almost every day while 78% of them bet on a weekly basis.

The rise of online betting platforms has made gambling even more accessible than before. With the help of hyper-gamified mechanics and the easiness of a single tap on their smartphones, a new generation of Greeks has been turned into an army of new addicts playing and losing money constantly.

Young Greek men are disproportionately affected by this, with many young women complaining about how their relationships became destroyed by the addiction of their companions. This is a serious issue with deep societal repercussions.

Greeks gamble way too much but invest way too little

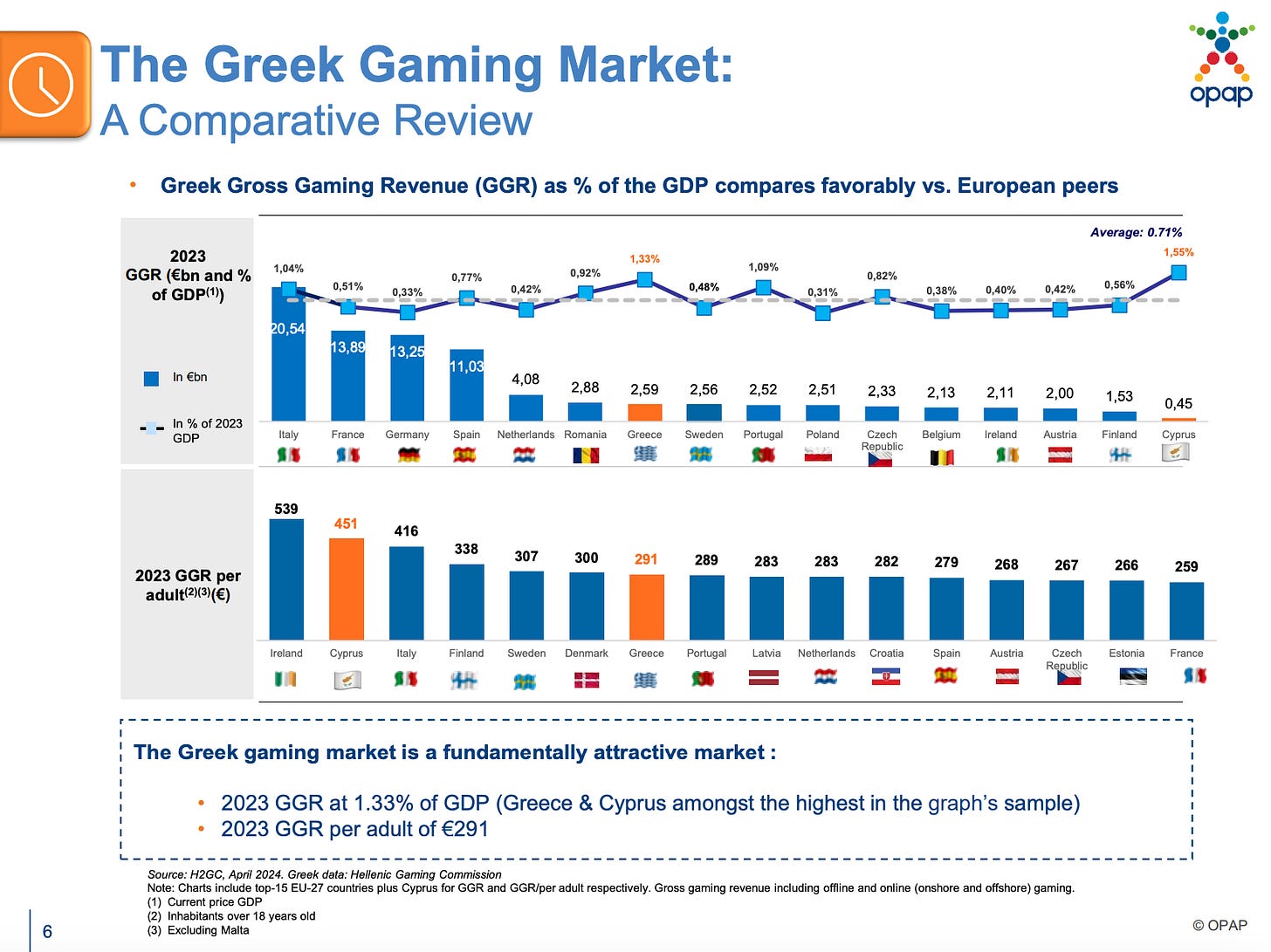

Gross gaming revenue (GGR) as % of GDP — a key metric used by gambling and betting companies to assess their performance — is the second highest in Greece across the entire EU. Greece also exhibits one of the highest GGR per adult, currently at €291 per adult. This means that Greek bettors are extremely aggressive.

What if instead of gambling €291 on (un)lucky games each year, the average Greek adult invested the same amount, say in the S&P500? That’s easy to calculate.

An €291 investment in the S&P500 in 2015 is about $304 in dollars would have become $813 in 2024, in inflation-adjusted terms.

Given a 10.53% annual compound rate of return over the same period, an annual investment of the same amount over 10 years ($3,344 in total over the years) would be worth $6,320 by the end of the decade.

Unfortunately, Greece lacks both a culture of saving/investing and the diversity/ease of options to do so. Banks currently pay negligible or zero interest rates for saving (even when they charge close to double digits for lending). And while local investment instruments do exist and are increasing in numbers, few Greeks have both the knowledge and the access to them today, especially those in the younger generation.

Financial education is an area Greece needs to do much more on. And fast.

Betting has taken over Greece, physically and virtually

Betting is not just a way of life in Greece. It seems to have become life itself.

Let’s start with the physical aspect of it.

OPAP, the leading Greek company organizing and conducting games of chance, is one of the most profitable conglomerates in Greece. The formerly state-owned gambling monopoly has been fully privatized since 2013. OPAP holds the exclusive rights to organize and manage numerical lotteries and retail sports betting in Greece.

OPAP has over 3,500+ physical locations (Points of Sale) all over Greece. This includes 3,164 OPAP stores and 366 gaming halls.

This number is larger than the locations of the two largest gas & petrol station companies combined (1,631 HELLENiQ ENERGY and 1,437 MOTOR OIL stations).

More than three times the approximately 1,200 physical locations of the four Greek systemic banks combined (Piraeus, NBG, Eurobank, Alpha Bank).

More than three times the number of locations of Hellenic Post / ELTA (1,187), the Greek postal service.

And more than 10 times the number of the largest telco provider COSMOTE (346).

The so called '“Propotzidika” — a term derived from the very popular PROPO game of luck played at OPAP stores — can be found at every street corner of the country.

In the physical world, Greece is drowning in betting stores.

The same is happening in the digital world, perhaps at an even greater degree.

According to a letter of the Hellenic Gaming Association (HGA) complaining about hyper-taxation and the rise of illegal/unofficial gaming to the Greek government, there are about 20 licensed providers of online betting / lucky games in Greece. These are also connected to 100s of smaller official affiliates that are allowed to promote betting services. The web of companies and websites operating together is truly astonishing and I urge everyone to have a good look at the link in the beginning of this paragraph.

This is not a coincidence: 7 out of 10 Greeks prefer online gambling.

Greece is also expected to see the largest rise in online gambling across Europe over the next few years. According to Altenar, a provider of sportsbook services to licensed gaming operators, that’s almost twice as much as in most other countries.

If we add to all that the incredible number of illegal entities (illegal bookmakers, unlicensed websites, underground casinos) operating in the country — valued at about €2 billion — the cocktail is evidently both toxic and overspilling.

Similar to the issue of short-term rental explosion we recently covered, the solution here is not to start banning everything. Rather, it is to create, monitor and enforce a proper framework in which betting can operate in the country. This requires working with betting agencies to actually promote responsible betting (not just in words, but with actions) and construct better legal safeguards, especially against the exposure of gambling/betting content to minors.

Betting ads — everything, everywhere, all at once

I recently played a game with myself. Whenever I happened to be in front of a Greek TV at night, I counted the number of times a betting advertisement would pop up during breaks. I did this during peak and off hours. I did this before, during and after news segments, popular dramas, reruns, game shows, and of course, sports events.

In most cases, the total number of betting ads was higher than all other types of ads served during the same air slot segment — sometimes marginally, but other times by a wide margin. What became clear to me was that TV time in Greece is flooded by betting ads like there is no tomorrow.

Betting advertisements are found everywhere around us in Greece. On the corner of every third street you pass to get to work. On the side of the bus or the inside of the train you use to go home. On the TV, when you watch anything from a cooking show to a documentary. On almost every Greek news website you open to learn what happened during the day. There is simply no escape.

This is not normal. This is not right. And this is neither conducive to a healthy society nor to long-term sustainable economic growth.

Where to go from here

One place to start is by investing more in the Hellenic Gaming Commission (HGC) and not to let their team dry out. From a staff of 173 people in 2014, HGC had a workforce of just under 70 people at the end of 2024. How can such a small team monitor such an increasingly expansive domain of illegal gaming, online betting and uncontrollable advertisement in the entire country? It’s already a miracle that they can function properly as is today.

Another thing we can do is to simply talk more openly about the real costs of our national gambling epidemic — on a human, social and economic level.

My small contribution to this necessary discussion is by writing this article.

Yours can be by watching the two exceptional videos posted below.

And then, perhaps, by helping spread the word.

P.S. The Hellenic Gaming Association (HGA) is the representative body of betting/gaming providers in Greece, not to be confused with the Hellenic Gaming Commission (HGC), which is the body responsible for monitoring and regulating the space in the country.

🏭 Economy & Business

Overall turnover index in industry for 2024 up by 2% compared to 2023

Annual turnover of enterprises for 2024 rises at highest level in 5 years

Inflation for Jan 2025 stands at 2.7%, remains fixed above pre-COVID levels

Social security contributions reduced for overtime, night shifts and holidays

Greek stocks to benefit from end of war in Ukraine, writes Goldman Sachs

Ship repairs in Greece near 700 in total last year, up from 330 in 2013

🤖 Tech & Startups

Nodes & Links (AI for construction) raised $12M in Series B funding

Anodyne Nanotech (biotech) praised for its patch drug delivery methods

Velos Rotors highlighted for their drone delivery capabilities in WSJ

Spin-offs in Greece — challenges and strategic imperatives

Europe Builds celebrates a great first podcasting season

How did Skroutz start? The founders of the Greek scaleup share their story

🙌 Celebrating Greek wins

Charis Katsis and George Androutsopoulos (both Computer Science Ph.D. candidates) have been recognized with one of Greece’s highest academic honors—the National Academic Excellence Award

Vagelis Papalexakis won the the 2025 PAKDD Early Career Researcher Award for his work in the field of data mining

Gus Constantellis honored Greek moms everywhere with an ode to his mom’s legacy

The Moiraitis Winery from Paros brings the Cyclades to our glasses

📌 Spotlight: Greek TV goes English (about time?)

Greek TV channel SKAI launches an English-speaking bulletin, the first of its kind (as far as I know) presenting news from Greece for a global audience on a daily basis.

I have long advocated for more Greek media content in English as a way to inform a wider set of stakeholders and also help the country’s soft power projection abroad.

Seems like SKAI’s new Managing Director Konstantinos Zoulas has started making waves, pivoting the channel from a reality-TV bonanza — Survivor fatigue was real — to a new set of (more serious?) shows that could win back a sophisticated and perhaps larger audience. Judging from his work spearheading ERTFLIX — the Greek public broadcaster’s amazing Netflix equivalent — much can be expected here.

This follows other existing projects like Kathimerini/NYT and To Vima/WSJ.

I only have one question about this: what took you guys so long!?

That’s it for today! If you enjoyed today’s newsletter, please let me know with a like or reply. This helps me focus more on topics that are useful to my readers.

Find me on X or Bluesky for bite-sized opinions.

Until next time!

Excellent article, huge problem.

The data points hit close to home, particularly given my personal history with sports betting arbitrage in the early 2000s - way before online betting colonised Greece.

What baffled me every time I spoke with anyone who's a casual bettor? The profound mathematical illiteracy that made OPAP's business model work. The core mechanics of Lotto and Propo relied on mass misunderstanding of basic probability. OPAP effectively operated a perfectly legal wealth transfer system from the mathematically uninformed to their bottom line.

My arbitrage days ended when banks started flagging certain bookmakers and restricting fund movements, even confiscating large sums. They smelled profit and they wanted a cut. I pivoted to building my career and left Greece, but reading this article confirms the fundamental problems have metastasised rather than resolved.

Three observations I see worth unpacking:

- Mathematical blindspots run deep. The average bettor remains unaware that each stake carries a guaranteed percentage loss to the house. Want to see teenage boys suddenly develop laser focus in math class? Add a module on calculating true odds versus bookmaker margins. The engagement would be remarkable.

- The private ownership model creates perverse incentives. Bookmakers operate with an asymmetric advantage - they'll accept any customer's money until that customer demonstrates consistent profitability. Then comes the swift ban. I can attest to that personally and extensively. This selective screening ensures the house maintains its mathematical edge against the retail crowd. A state monopoly running simple games with profits directed to social programs would at least align incentives with public good.

- The lack of accessible investment alternatives amplifies the gambling problem. While the article highlights the potential returns from systematic S&P 500 investing, Greece offers minimal financial education and high friction barriers to legitimate investment. Contrast this with the UK, where opening an ISA account takes 15 minutes and provides tax-advantaged access to global equity markets. Will some people still chase imaginary crypto riches? Absolutely. But creating accessible pathways to long-term wealth building gives the mathematically inclined an escape route from the gambling trap.

The numbers in this article suggest Greece's gambling addiction has reached a critical mass. Addressing it requires rethinking both the incentive structures and the alternatives available to citizens looking to build wealth.

I am trying to think how I can help be a solution to the problem.

A potential solution keeps tugging at my mind: an application delivering easy-to-digest investment education with simple translation to trading functionality. Converting that gambling dopamine hit into calculated equity analysis.

The interface could bridge, subtly, familiar betting mechanics with fundamental company research. Make the first steps into investing feel natural for a population raised on OPAP's platforms. Just an idea on how you can show that (well educated) "betting" on equities can be much more healthy and profitable than straight-up gambling, which will never ever work.

Two open questions from me:

- The Greek brokerage infrastructure - actual mechanics, regulations, barriers to entry

- The funding landscape - would Greek VCs back a platform aiming to redirect capital from betting to investing?

The government could accelerate this transformation through targeted grants. Every euro flowing from gambling into productive investment compounds for decades. Having it flow to Greek equities, amplifies the incentives. Building an investing ecosystem demands policy support: lower friction for retail investors, tax incentives for long-term allocation, coordinated educational initiatives.

€15.6 billion currently evaporates in betting. The market seems primed for a platform making investing as accessible as those omnipresent gambling apps. The blueprint might blend thoughtful product design with policy reform.

I'm so happy that we talk about this.

I only visit Greece once a year, but on my last visit, I realised that my 18-year-old nephew has a gambling addiction, and then I started noticing it everywhere. Anecdotal evidence: I was sat in the metro next to 4 teenagers, glued to their phones (not good but normal), and I overheard they were all betting on games as we travelled. This is serious.