Greece’s general election is right around the corner, taking place this Sunday (May 21).

While there are some good reasons to be optimistic about Greece, and recent indicators point to a gradual but sustained path towards a more prosperous society, I wanted to understand better the amount of progress (or regress) the Greek economy has achieved during these past few years. (Yes, the baseline is still very low, but for a country that has experienced the greatest depression on record, that’s a given.)

Following a semi-Socratic method of inquiry, I will ask and answer a few key questions that hopefully can give a good indication on whether Greece’s economy is improving or not.

Let’s dive straight right in.

Is Greece growing?

Greece lost a very chunky part of its GDP during its decade-long financial crisis, and it will take some time until it reaches its pre-crisis level. But is all hope lost? Well…

The average annual rate of change of Greece’s GDP has grown 3x during 2019-2022 as compared to the previous period in 2014-2018, from 0.5% to 1.8%. It is now even higher than the EU average rate of 1.3%, growing faster than many other advanced economies in Europe. A similar shift can be seen in GDP per capita.

The European Commission forecasts that real Greek GDP change will remain higher than in the EU for both 2023 (2.4% GR vs. 1.0% EU) and 2024 (1.9% GR vs. 1.7% EU).

Greece is, in fact, growing. Some are now even dubbing it a “European growth Tiger.”

Is investment in Greece increasing?

Total investment in Greece has increased, from an average annual rate of 0.7% during 2014-2018 to an astonishing 7.7% between 2019-2022. At the same time, the EU average fell from 3.6% to 2.2%.

This is not a coincidence. Foreign Direct Investment (FDI) has been booming in Greece, achieving two consecutive all-time-high records in both 2021 and 2022.

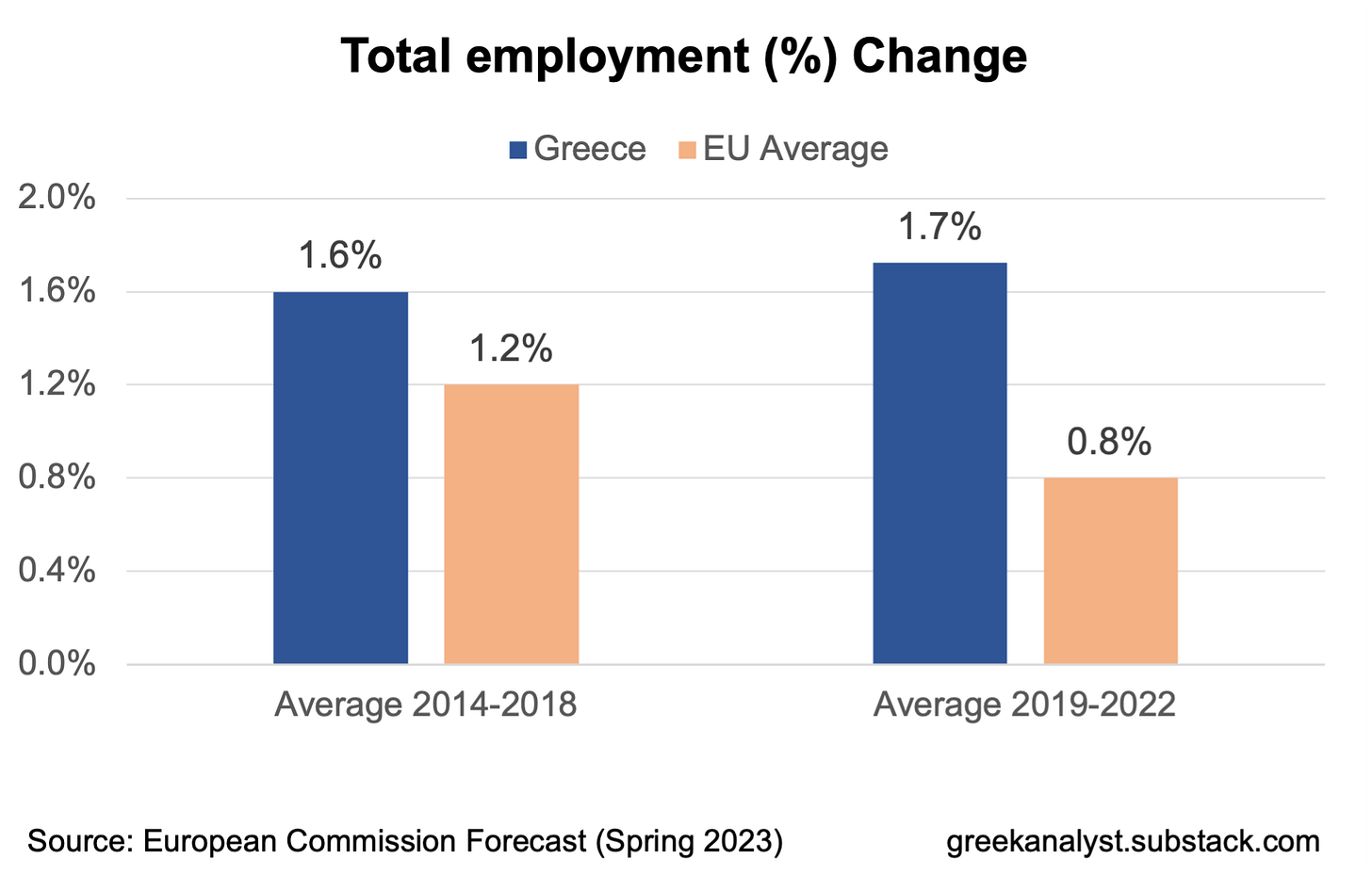

Are Greece’s employment prospects getting better?

Total employment has been increasing in Greece faster than the EU average under both of the last two Greek governments, improving during the last four years even when the EU number fell.

Skyrocketing soon after the Greek financial crisis erupted, unemployment in Greece has been steadily falling, inching closer to the EU average. The improvement and reversion to the mean is undeniable, and will hopefully continue going forward.

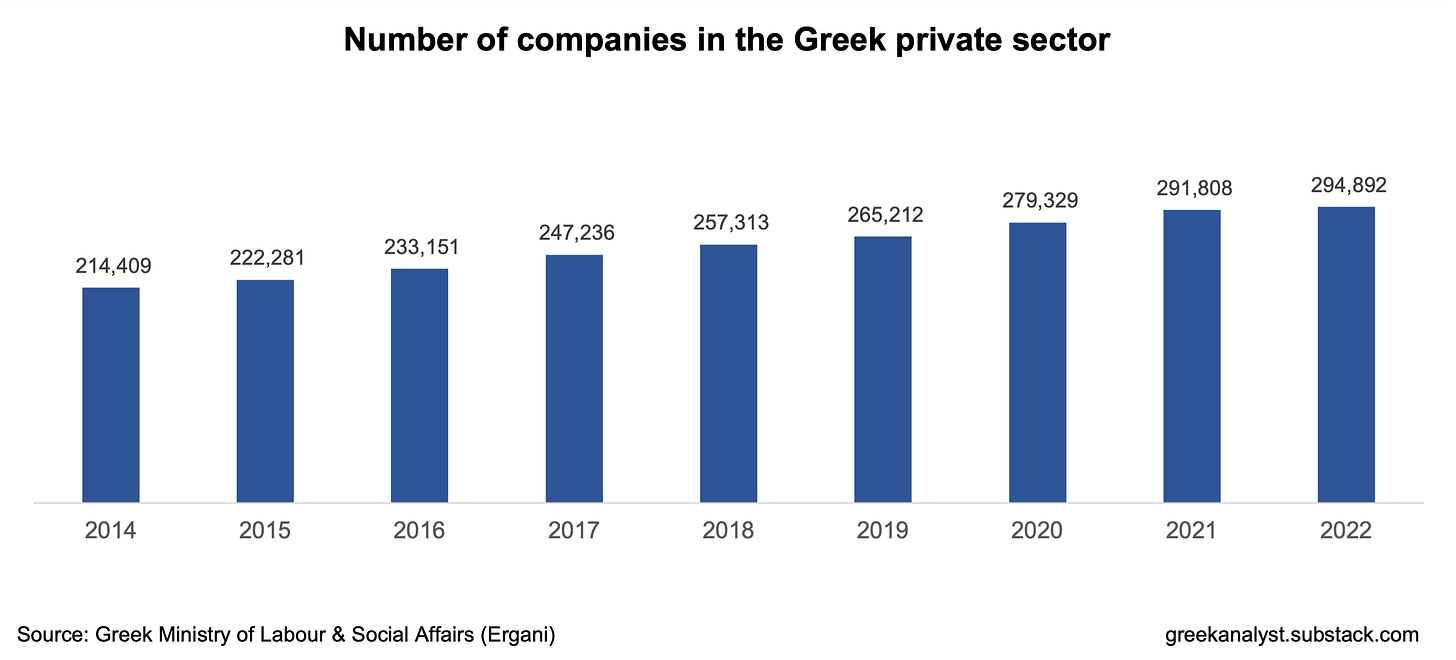

How are Greek businesses doing?

The number of companies in Greece has been steadily rising, increasing by almost 38% since 2014. Business activity has been certainly booming.

Greece saw a higher net total change in private companies during 2014-2018 (+42,904 businesses created) than during 2019-2022 (+29,680 businesses created). If we break this down by company type, we will see that more micro, small and medium-sized companies were created under the SYRIZA-led government, but a higher number of large businesses were created under the New Democracy one.

What’s the reality for Greek employees?

The total number of employees in the Greek private sector has increased from 1.5 million in 2014 to 2.2 million in 2022, an increase of about 46%.

This is a great response to critics who argue that the unemployment rate is only decreasing because people are emigrating out of the country. Contrary to their claims, actual job creation is a true and important driver of positive employment dynamics in the country (and the ‘brain drain’ is also decreasing every year).

One big problem still faced in Greece are salaries. While the change in compensation of employees per head has turned positive on average in 2019-2022 (+0.4%), it still is negative in real terms (-1.3%) — i.e. when we account for inflation. This is a key reason why salary increases are not felt that much by the average Greek today.

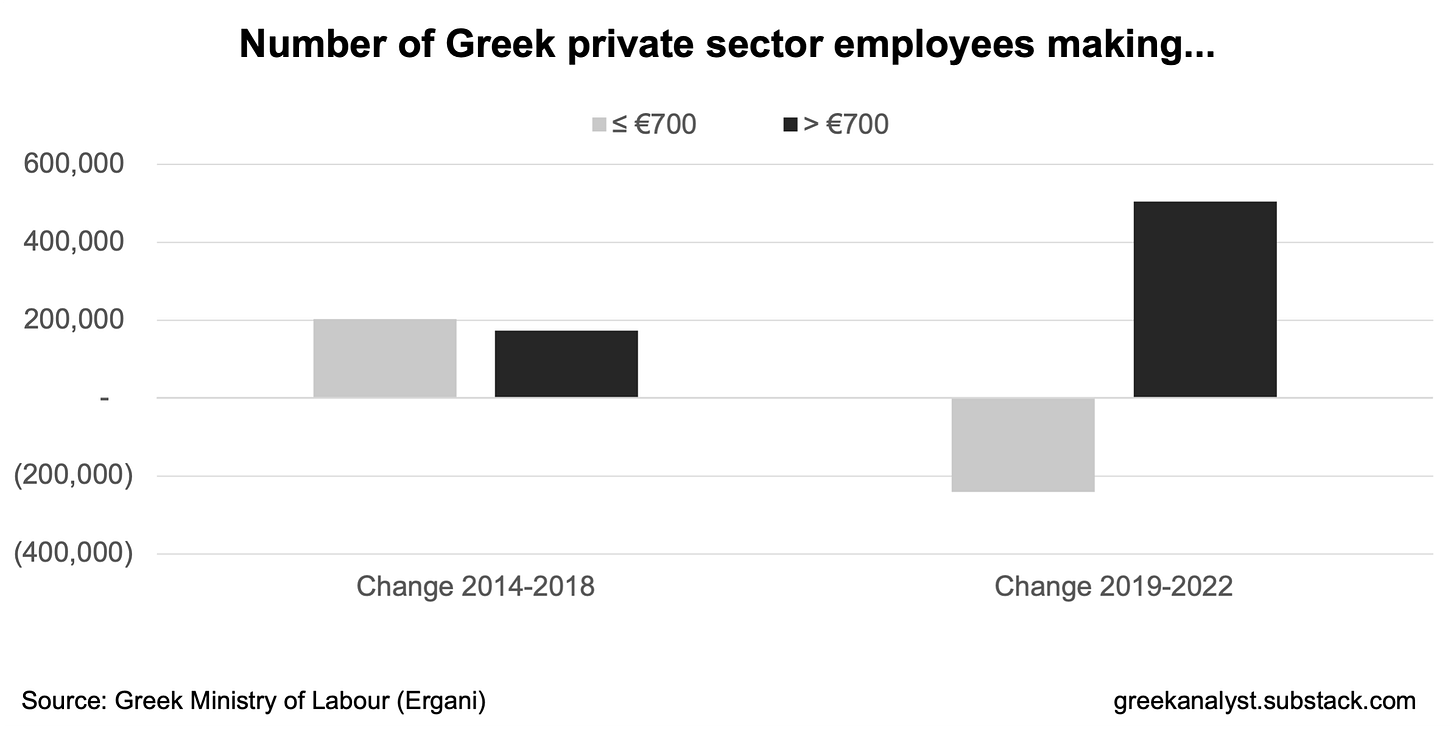

But how have salaries changed in the past few years? During 2014-2018, the bulk of new jobs created where for very low paying jobs (≤ €700). In contrast, 2019-2022 saw a significant boom in medium- and high-paying jobs (> €700).

To put things into perspective, the SYRIZA era under Tsipras saw the creation of +203,525 new jobs paying ≤€700, while the New Democracy era under Mitsotakis saw the decrease of jobs at this level by -241,861. In contrast, the SYRIZA era saw the creation of +173,241 jobs paying >€700, while the New Democracy era saw +505,124 new jobs paying >€700 being created — a number three (!) times higher.

The improvement in salaries during the 2019-2022 era can be witnessed across every single salary band above €700. Greeks have clearly started making higher salaries.

This can also be seen by the increase of average gross earnings per private sector employee, which went up from €1,042 in 2014 to €1,176 in 2022. The net change from 2014-2018 was +3%, while during 2019-2022 the net change was an impressive 12%.

Still, much more needs to be done, especially in this highly inflationary environment. Both employers (by offering better salaries and working conditions) and the state (by reducing taxes & social security contributions further) must help drive the number up.

Is Greece becoming poorer?

Greece is consistently faring better across key poverty indicators. Relative median at-risk-of-poverty gap, population at risk of poverty, material and social deprivation) have all improved materially since 2015. This is a very important achievement.

Following the double-whammy of COVID and global inflation, population at risk of poverty jumped in 2021. It is now falling again, but this shows that progress is not linear and can easily change direction due to external (and even domestic) shocks.

Conclusion

Greece is growing, investment is booming, employment prospects are improving, the number of businesses is moving up, salaries are increasing, and the country is becoming less poor, not more.

Much more needs to be done to maintain and improve on this trajectory, but there is little doubt that the Greek economy has been doing better.

Fingers crossed, it will continue doing so even after the election on Sunday.

Would you say that Greece's economy will keep improving for the next 8 years? I am not expecting to sustain these high rates but a relatively steady economic growth.

Well done for a thorough analysis and overview. I think regarding FDI there are questions as to where is really the money going . It seems it is mainly in real estate and hotel development but not enough in productive sectors . Also the debt to GDP ratio is slightly misperceived as inflation favors liabilities even if there is no real growth . Overall a positive trend in Greece but as you rightly say a lot to be done .