The Greek shadow economy

Our "big fat Greek tax evasion" is actually getting leaner

Welcome to the 50 awesome new readers who joined in the past two weeks!

If you haven’t subscribed, join 2,614 smart, curious people interested in Changing Greece.

😶🌫️ The Greek shadow economy

Tax evasion: a Greek love story?

The concept of tax evasion is not new in Greece.

One could say that it is a defining feature of the modern Greek economy.

It has been a widespread phenomenon for decades, especially across self-employed individuals, small and medium sized businesses (SMBs), and of course, High Net Worth Individuals (HNWI) such as our magnanimous Greek shipping class.

I recently wrote about it in the context of Greek salaries.

Greece has traditionally been a cash-based society with a high degree of informality.

This made it easier for people to declare far less than their actual income to tax authorities, avoid paying taxes altogether, or even sell real estate assets at a significantly higher price than the one reported (pocketing the difference in cash).

But the easiness (until recently) and social prevalence of tax evasion is not the only reason pushing Greeks to engage in it. There are also existential reasons.

High taxation and continuously changing tax legislation have made it enormously difficult for any Greek business (small or large) to survive as honest players and also plan ahead in this heavily skewed economic system.

But not all hope is lost.

Thanks to Greece’s digitization efforts, tax evasion is becoming harder.

And no, not all Greeks fall under the tax-evasion caricatures so commonly painted by foreign media during the financial crisis.

Let’s have a look at the data.

How big is the Greek shadow economy?

What’s the size of Greece’s shadow economy?

It is exceptionally hard to come up with a robust answer to this question.

Most studies estimate the size of the Greek shadow economy somewhere between 20% and 40% of GDP. This is a pretty large range but it gives a good indication of how massive the (untaxed) revenue from informal activities is for the country.

According to a study by Eurobank, the size of the shadow economy in Greece stands between 20-30% of the country’s GDP per year. This is in line with Bank of Greece governor Stournaras’ assessment, which places the number around 21% of GDP.

Another study by Koufopoulou et al. (2021) following a Multiple Indicators Multiple Causes (MIMIC) model confirms these findings.

The MIMIC model also shows that the percentage of tax evasion is gradually dropping after the crisis (keep reading to find out why).

In a seminal paper co-authored by Nikolas Artavanis, Margarita Tsoutsoura and Adair Morse (2015) based on data from the pre-crisis era, they estimated that 43%-45% of self-employed income in Greece went unreported (and thus untaxed).

Interestingly, the same paper found that the primary tax-evading industries were professional services — medicine, law, engineering, education, and media.

So the size of the shadow economy is still large.

But this seems to be gradually changing for the better.

Greek trends of economic informality dropping

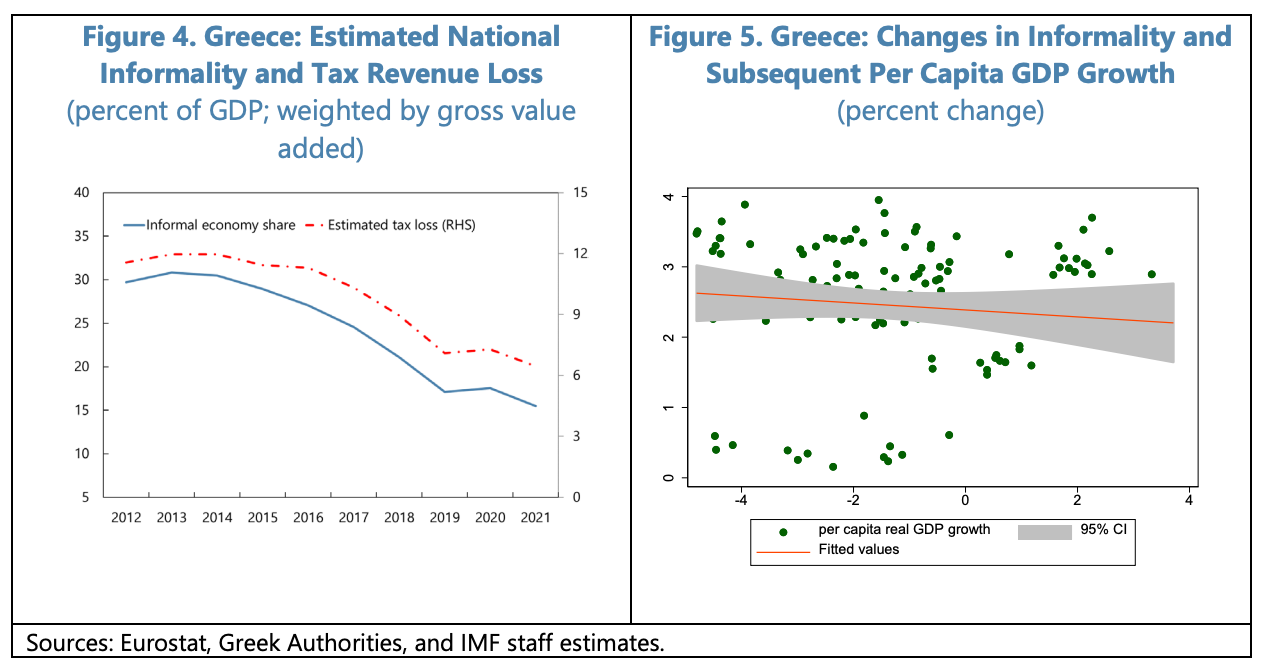

A recent paper by the IMF investigating the Greek shadow economy found that it has dropped significantly over the last decade.

The estimates show that trends of economic informality have decreased notably across all regions of Greece over the last ten years.

The estimated decrease in informality is associated with both lower tax revenue loss and higher per capita GDP growth for Greece.

This is not a coincidence. The proliferation of digital payments after capital controls (2015) and the COVID era (2020-2022) has provided a boost to public revenue coffers.

Greece was traditionally a cash-based society. But after 2014, a digital revolution started taking place.

According to data from IOBE, since 2014 the number of card-based transactions has increased more than 20 times, while their value has jumped almost 9 times.

Many professions (such as taxi drivers) historically excluded (hint: protected) from offering cashless options have since early 2024 been required to offer them.

Inspections have increased, especially across the Greek islands, which have a notoriously high number of tax evasion offenders operating in the tourism industry.

Today, the bulk of tax evasion seems to have moved to the mainland, primarily found across restaurants, coffee bars and retail stores.

How does Greece compare to other countries?

From 1999 to 2007, a detailed study by the World Bank ranked Greece second across 25 OECD countries in terms of its estimated shadow economy size.

Almost a decade later, the picture seems quite different.

A follow-up study conducted by the IMF ranked Greece as having the 12th largest size of shadow economy across 31 European countries in 2017.

This is a significant decrease and does not even capture the recent positive changes from increases in digitization. However, it also seems to reflect the lower bound of shadow economy estimates, so the total number is probably still quite higher.

What else can Greece do against tax evasion?

Hitting hard on tax evasion is easier said than done.

Consecutive Greek governments have tried it with mixed results at best.

The current government has also attempted to tackle the issue with measures that seem directionally correct but an implementation that led to many protests, especially by self-employed individuals.

What else could Greece do?

There is one simple solution that research shows can produce meaningful results: decreasing the Value Added Tax (VAT) rate.

In a 2021, Nikolaos Artavanis published a study on the relationship between VAT rates and tax evasion with evidence from the Greek restaurant industry. His results were pretty startling:

I find that a large, unexpected reduction in the VAT rate from 23% to 13% on nonalcoholic restaurant sales in Greece significantly increases sales reporting. I also document the opposite effect for the reverse VAT rate change two years earlier. The effect is more pronounced in small firms and is monotonic with respect to the level of alcoholic sales, whose rate remained unchanged. These results suggest that firms actively adjust their reported sales to tax rate changes—at a level that maintains a targeted ratio of tax liabilities to credits—in order to avoid signaling evading behavior to tax authorities.

This should not be news to anyone conducting business in Greece. Businesses that often have to deal with changing tax legislation and new taxes introduced by different governments have found creative ways to protect their bottom line.

Lowering the VAT rate — and other taxes too, such as the (still, very) high social contributions paid by employers — could make businesses more eager to be honest in their reporting.

Greek governments are reluctant to make such changes. Taxes like VAT or the Uniform Real Estate Property Tax (ENFIA) produce a predictable stream of revenue for the public coffers so they do not want to run the risk of losing any of that.

I personally believe there is much more room in reducing them.

If Greece wants to become a modern and prosperous economy, it will need to create the proper conditions for honest business-making and individual living to thrive.

This does not end with lower tax rates. But it definitely can start there.

🏭 Economy & Business

ATHEX shortlisted by FTSE Russell for upgrade to “Developed Market”

Unemployment in Greece drops to 9.5% in August 2024

Exports are rebounding but the trade deficit is widening

Greece borrowing cheaper than most top economies in the world

Industrial production since 2021 highest across all EZ countries

Disaster relief north of €100M approved by the EU for Greece

Stournaras’ latest comments on ECB cut rates make it into the FT

🤖 Tech & Startups

Resolve (AI powered software engineering) raised a $35M Series A

Numa (AI car dealership automation) raised a $32M Series B round

Series (AI game development) raised a $28M Series A round

Enlaye (AI for construction risk) raised $1.7M in pre-seed funding

Sun, sea and startup visas - Sifted on Greece’s new attractiveness

“Stop being fancy” - Skroutz’s CEO advice to new startups

Vitalik praises two Greek-founded companies in the same tweet

🙌 Celebrating Greek wins

Greece records historic win over England, dedicated to George Baldock

Mimis Plessas (in memoriam) leaves a unique musical legacy behind

Demis Hassabis (DeepMind) wins Nobel Prize in Chemistry

Ilias Pistopoulos makes TikTok filters that go viral globally

📌 Spotlight: How business ready is Greece?

The OECD recently published its Business Ready report for 2024.

The report assesses the regulatory framework and public services directed at firms, and the efficiency with which they are combined in practice, across countries.

How well did Greece do? Surprisingly, better than I expected.

Greece scored on the top quintile in two of the three main pillars of the report, Regulatory Framework and Public Services. It sadly scored on the fourth quintile on Operational Efficiency (lots of room for improvement there).

The overall result is pretty good, with very few out of the 50 countries faring better.

That’s it for this week. I always love hearing from you. Make sure to hit that reply button.

Find me on X or Bluesky for bite-sized opinions.

Until next time!

It is encouraging news. However, just the other day, we were told that someone was selling a brand new flat at a new construction site and was offering a 50K discount on a 750K asking price if 1/3 were paid black. I mean really, is this still happening? Are people still paying 200K cash?? How does that even work?

Greeks are some of the hardest working people in the world. they are also taxed the hardest.If I was working in Greece I would be trying my hardest to minimise my tax.

Let's not get started on the 24% Vat, land taxes, and everything in between.

People outside Greece just don't get it..