The State of the Greek economy (Q1 2025)

30+ charts, many insights and the occasional joke

Welcome to the 74 awesome new readers who joined us in the past week!

If you haven’t subscribed, join 3,282 smart, curious people interested in Changing Greece.

📊🇬🇷 The State of the Greek economy (Q1 2025)

Welcome to the first of what I aim to be a quarterly update on the macroeconomic reality and other top data relevant to Greece. The title of this series was inspired by the popular US-based research of the great

.Your time is valuable, so let’s jump straight in.

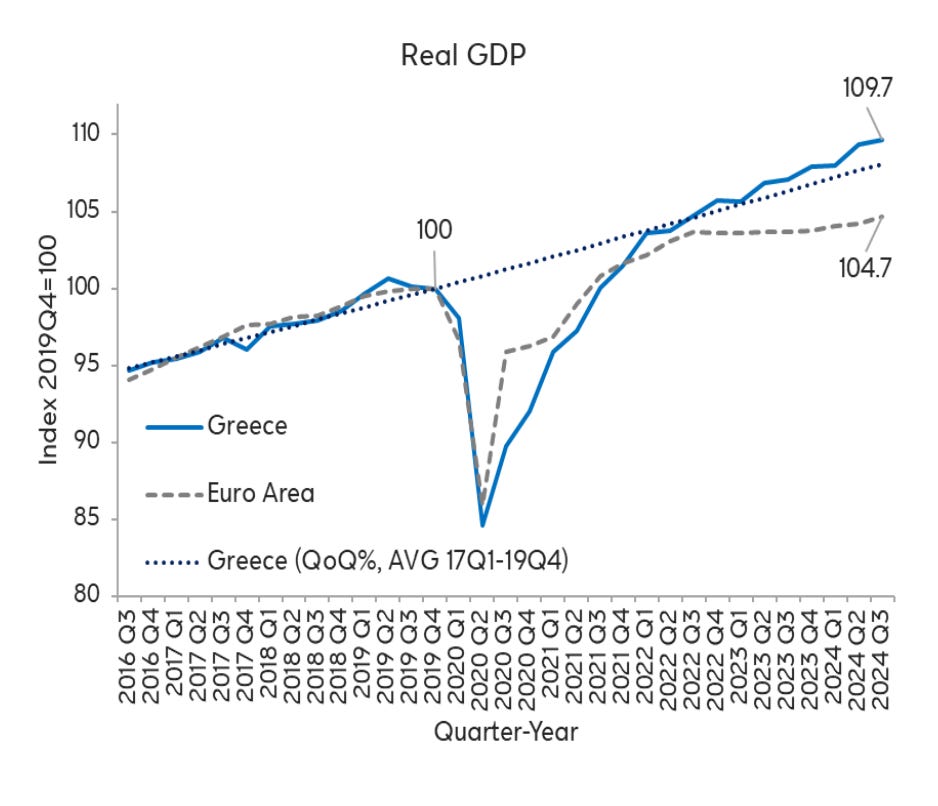

1. Greece’s GDP growth remains robust

Greek GDP growth expected to close around +2.3% for 2024, and expected to continue growing around the same level in 2025 (IMF projects +2.1%, EC +2.3%).

The Greek economy is expanding faster in real terms than the Euro Area average.

2. Macro fundamentals (surprisingly) still strong

A combo of four factors show that the underlying macro fundamentals of Greece remain surprisingly strong even to this day:

Unemployment rate at 15-year low & participation rate at all-time high

Real disposable income increases for 3rd consecutive year

Labor compensation continues growing (in absolute and % terms)

CPI still higher than pre-pandemic levels but easing gradually

Long term unemployment (people who have been unemployed for 12 months or more) continues to decrease, but it is still above its pre financial crisis levels.

Given the tightness of the labour market, the actual problem is not the lack of jobs. In fact, there is an estimated 200,000 vacant job positions in the country today. Rather, the main issues are (a) a mismatch in skills between job seekers and market needs, (b) low salaries due to a combination of short-sighted managerial culture among Greek businesses and extremely high employer/insurance contributions, and even more importantly, (c) the continuous benefits/allowances/passes that the Greek government has been giving away, which reduce incentives for (young) job-lookers to go find a proper minimum wage / entry-level job.

3. Disposable income growing in real terms

Gross disposable income continues to increase, but consumption is also going up.

During the first 9 months of 2024, disposable income for Greek households in gross terms increased by 5.6% annually, with inflation at 3%.

This means that the real disposable increased by 2% for Greek households. This was primarily driven by an increase in compensation of employees.

Compensation of employees in Greece is now growing around 9% year over year.

4. Wealth gap (perception) persistent

Despite the increase in real disposable income and employee compensation, Greeks still perceive a large wealth gap to exist in the country.

Among 25 countries surveyed by the IMF, Greece exhibited the 3rd largest difference (after UK and Turkey) between people who believe the gap between the rich and poor is a big problem and those who think it is not.

More than 70% of Greeks believe that when their children grow up in the country, they will be worse off (i.e. poorer) than their parents. For context, the average is 57%.

5. Bank deposits going up

Confidence in the Greek banking sector is rising, with aggregate customer deposits in local banks reaching EUR 250 billion in 2024. This is 31% higher than 5 years ago.

Still, interest rates for savings remain abysmally low (if not non-existed), which is also why the Hellenic Competition Commission initiated a sector-wide inquiry at the end of last year to investigate the practices of the four systemic Greek banks.

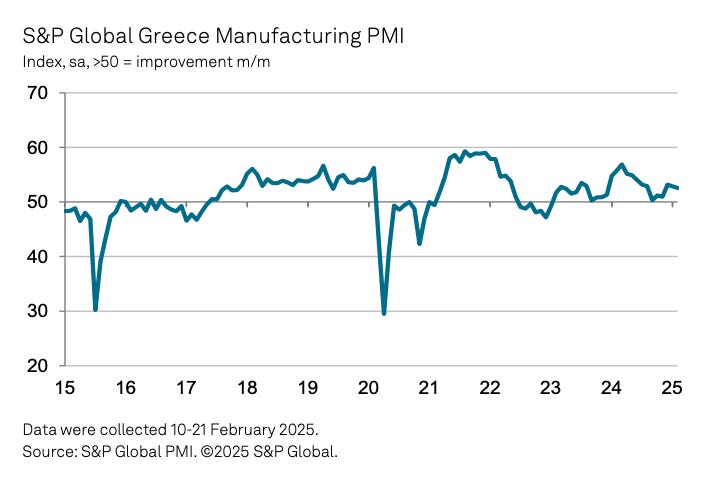

6. Manufacturing output shows resilience

Greek manufacturers continue to see growth in the sector, as output and new orders rose again through the first quarter of 2025.

Greek manufacturing conditions remain better than the Euro Area average.

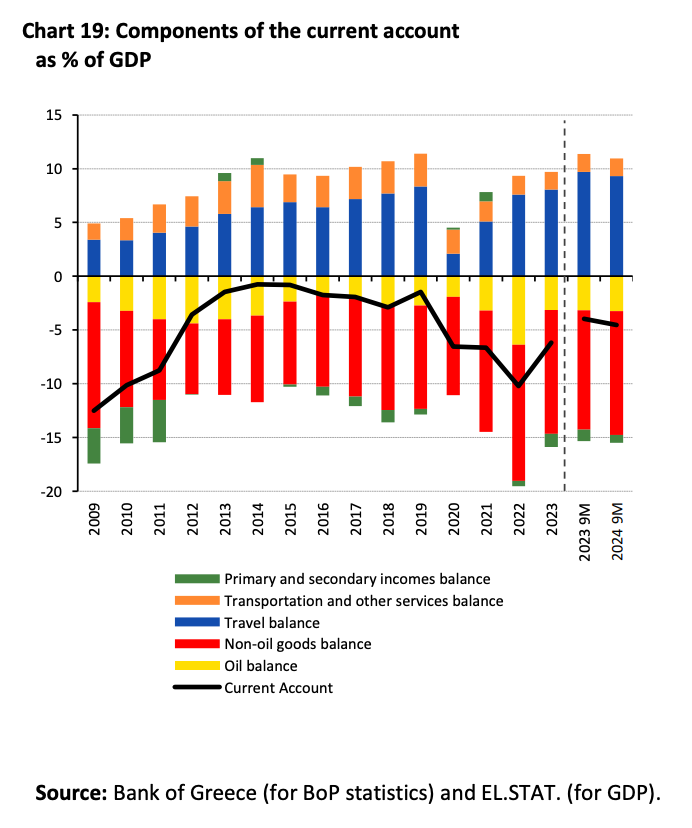

7. Current account imbalance still a big problem

Greece has a large current account deficit that has started widening again.

What does this mean in practice? In simple terms, Greece is importing significantly more goods in the country than exporting to other countries.

This has been a historic problem for Greece and perhaps the largest macroeconomic imbalance facing the country today.

8. High export concentration in only few companies

Greece’s exports are concentrated heavily among a few large enterprises:

the top 5 enterprises are responsible for almost one third (29.5%) of Greek exports

the top 50 enterprises are responsible for half (49.7%) of Greek exports

the top 500 enterprises are responsible for 3/4 (75.8%) of Greek exports

9. Debt and deficit keep going down

General government deficit is shrinking, finally close to turning into a surplus again.

General government gross debt as percentage of GDP has fallen from 209.4% during the peak of the pandemic in 2020 to 154% in 2024. It is expected to fall even more to 147.5% in 2025.

This dual reduction is crucial for the resilience of the Greek state and the stability of the Greek economy, especially in an increasingly uncertain global environment threatened by new trade wars.

How is this is possible? That’s because of the explosion in revenue collection from the state, especially after mandating the option of electronic payments across all sectors and institution better monitoring mechanisms. It has become much harder to tax evade in Greece today, which means that billions of euros in undeclared income that went under the radar for years have now started coming to the surface.

State revenues have skyrocketed to €74 billions and almost matched expenses.

10. Investments continue flowing in, mainly in property

Net Foreign Direct Investment (FDI) inflows in Greece continue on an upward trajectory in 2024.

Real estate remains the largest sector of FDI investments in Greece, accounting for about half of total inflows.

You know what the craziest thing is? Since 2022, Greece’s net FDI as % of GDP has been higher than the EU, OECD and world averages. Astonishing to say the least.

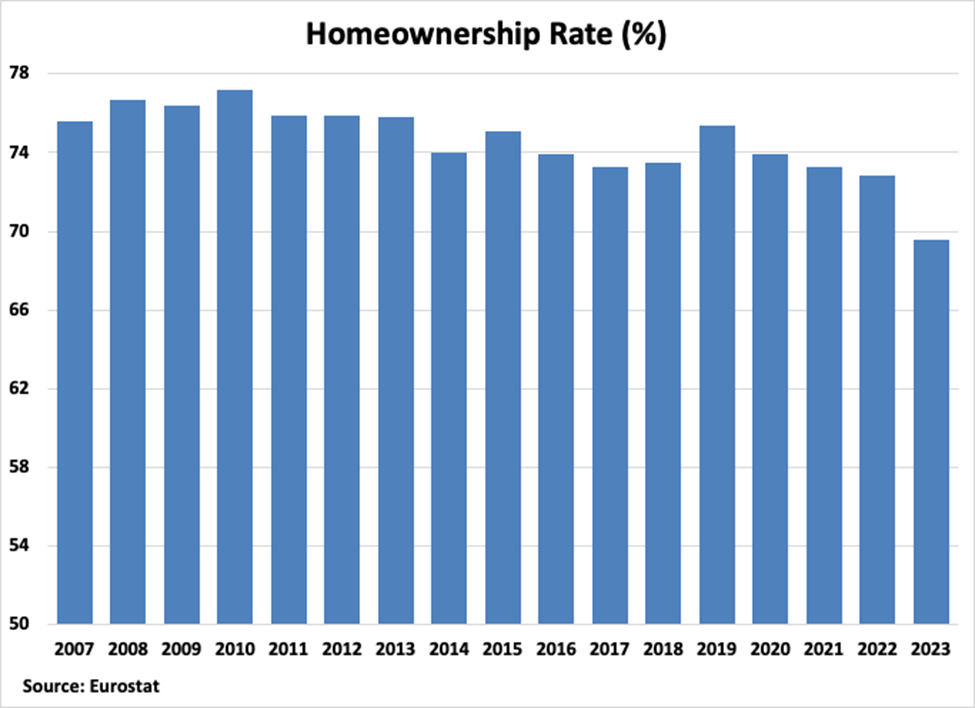

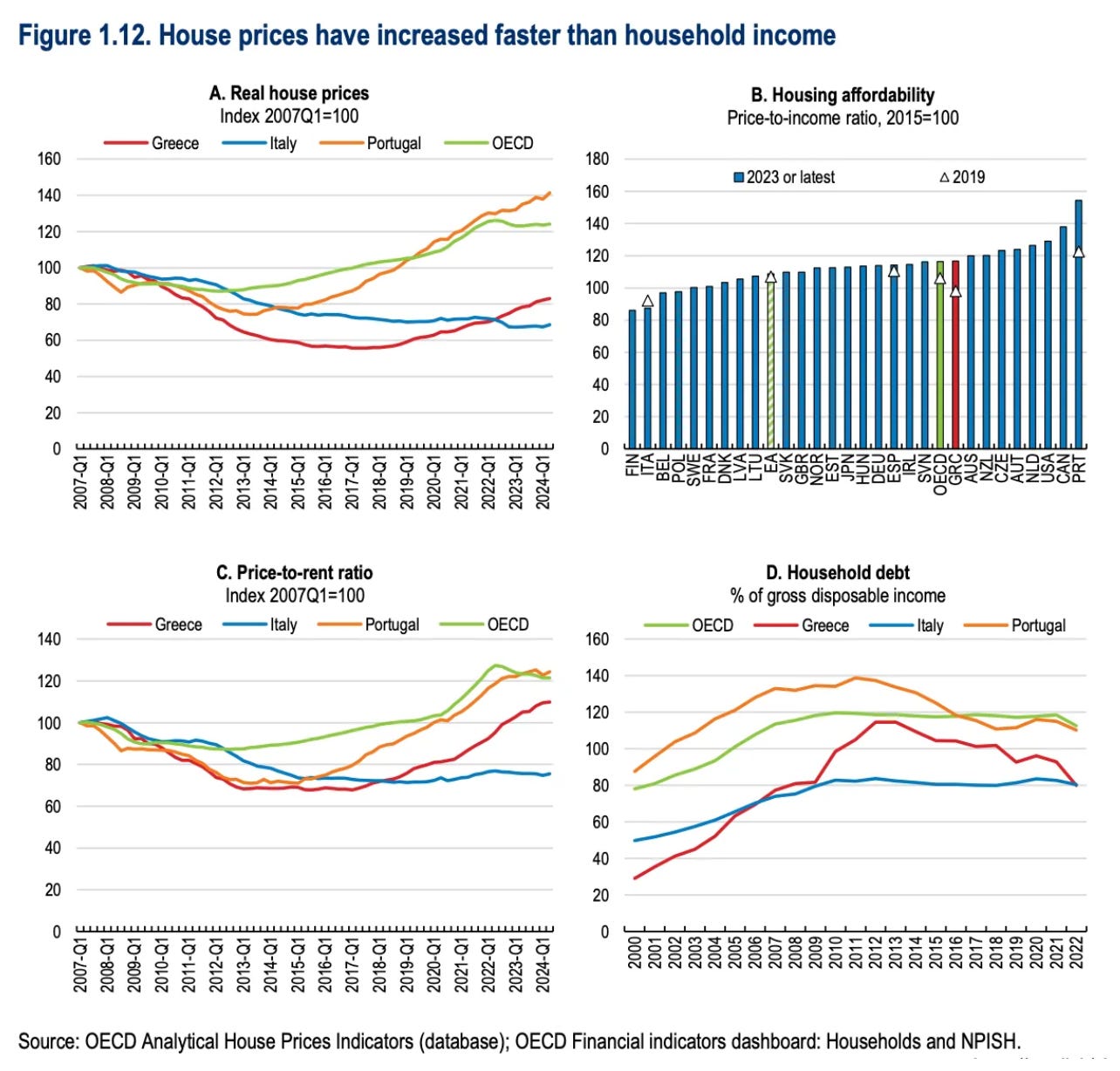

11. Frothy real estate market meets affordable housing crisis

House prices keep rising in both commercial and residential housing market, but they remain below Euro Area average.

Private building activity continues strong, both in terms of new permits issued and surface/volume being built.

Home ownership rate is falling, with more Greeks being forced to rent.

Greece is leading in terms of rental income as share of disposable income growth. In simple terms, many Greeks make a significant portion of their earnings by renting their property.

We have previously talked about the Athenian housing crisis, but housing market pressures are felt by the entirety of the country: average house prices have increased much faster than average household income.

For context, rents have increased by 49% in 6 years in some areas, and while real net income has also increased, it has been marginal compared to that.

12. Migration flows increasing again

Number of migrants and refugees arrived in Greece by land and sea has been increasing, reaching in 2024 the highest level in 6 years.

Greece is not the only country facing strong migratory pressures. It’s a wider problem for Southern Europe at large.

13. Political instability rising fast

(Disclaimer: What follows is merely an opinion based on my own interpretation of events. Many of my wonderful readers might disagree with this assessment and that’s perfectly fine. As a political centrist, I have a bias for looking at things from the middle. This does not always make my analyses liked by everyone or necessarily correct. However, they have been proven directionally accurate for over 10 years, so I hope you find some value in them.)

The New Democracy (ND) government is plunging in ratings following its disastrous handling of the Tempe crash aftermath, the irresponsible arrogance guiding many of its top stakeholders, the internal “Game of Thrones” taking place within the ruling party, the media frenzy cultivated by a number of dissatisfied Greek oligarchs and a very effective disinformation campaign taking place in social media since last year.

Rather than emerge as a serious opposition contender, PASOK has chosen to follow an aggressive yet highly conspiratorial strategy to score political points against ND. This has proven both dangerous as well as misguided; instead of rising in the polls, PASOK has been gradually falling, as it has embraced positions promoted by the most fringe political entities who have now gained increased momentum.

The extremes on both ends are rising, taking advantage of the justified public anger regarding the Tempe crash situation. Conspiratorialism is back with a vengeance. Trust in core democratic institutions, such as the justice system and the parliament, is at record lows. Following the largest peaceful protest in modern Greek history, violent riots and anarchist-led chaos are now re-appearing in both Athens and Thessaloniki.

Regardless of how much the government wants to avoid early elections, this scenario is getting traction. Unless PM Mitsotakis is able to make a real and meaningful grand gesture that will calm the waters and reclaim some of the government’s public legitimacy, the writing is on the wall. A very successful first tenure has been followed by a very poor second one. And yet, with no competent alternative in sight, Mitsotakis still remains the “most suitable party leader for PM” in polls (well, after “nobody”).

Ultimately, Greece will soon be forced to drink the strongest type of cocktail mix imaginable: ultra high domestic instability coupled with mega levels of geopolitical uncertainty — on the rocks. Let’s see if it has the stomach for it.

Conclusion

Greece’s macroeconomic fundamentals remain quite positive.

At the same time, political risk levels are going up fast.

The situation is very fluid, but I expect this to be the beginning of a rough new cycle.

🏭 Economy & Business

Greece and Poland are the only two EU countries in NATO spending significantly above 2.5% of GDP on defense for a consecutive number of years

Unemployment reaches new record low of 8.7% for January 2025 with concurrent record high number of 4,288,284 employed persons

Greece and Club Med are more than just tourism and transportation argues S&P, as share of real non-tourism exports have been rising since 2009

Threshold for highest tax rate (today at 44%) should be doubled from €40k to €80k, argues Miranda Xafa, former IMF executive board member

Greece in Numbers — the new open-source portal for Greek data co-sponsored by IOBE, the Hellenic Observatory at LSE and Yale Macmillan Center

Ideal Holdings receives major €115M + €200M investment from Oak Hill Advisors

🤖 Tech & Startups

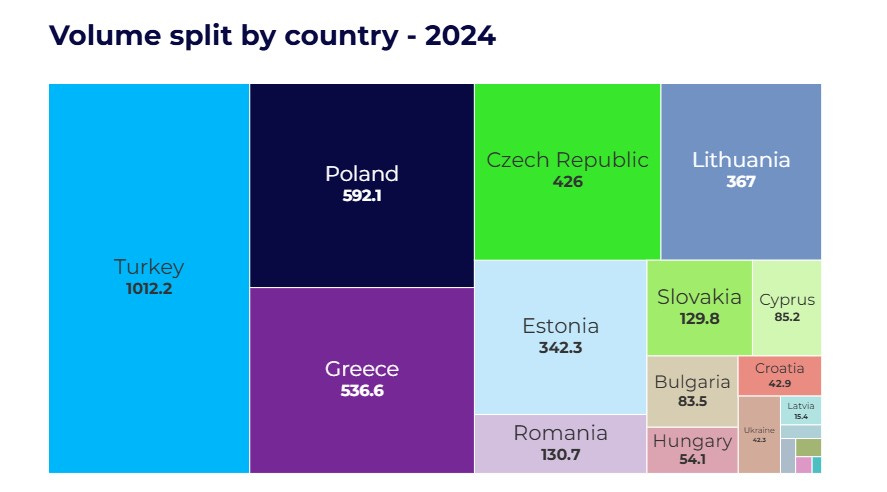

Greece comes 3rd in Eastern Europe in terms of VC funding volume for 2024

Three Greek hubs selected in the FT’s list of Europe’s leading start-up hubs

National Council for Research Tech & Innovation faces series of resignations

Open source AI is the way, says Manos Koukoumidis in the Startup Pirate

Northern Greece has a vibrant tech ecosystem, argues Aristos Doxiadis

Hellenic Navy is looking to procure maritime UAV technology

Greek-founded startups highlighted during HIN event at NYC city

Greek Elixir community has been started by Panos Amoiridis

🙌 Celebrating Greek wins

The crew of Pipinos — the Hellenic Navy’s submarine — deserves our gratitude

Constantina Theofanopoulou is connecting the power of dance with science

Nikolas Kontaxis is a magnificent neurodivergent painter wowing the US

Arnea is one of Halkidiki’s most beautiful villages, an architectural gem

📊 Insight of the week: Temperature is rising fast

The average annual temperature in Greece in 2024 was the highest in 34 years.

With the trend clearly moving consistently upwards, Greece’s changing climate conditions must become a key area of focus. Everything, from our agricultural crops to our tourism-based economy, depends on our historically temperate climate.

Recent years full of extreme events — including mega fires and floods that have become annual phenomena — should alert us that what we long considered ‘normal’ weather is no longer the standard.

Unless we plan ahead and start making some difficult decisions today, we will be forced to take much more difficult decisions in the not-so-distant future.

That’s it for today! If you enjoyed today’s newsletter, please let me know with a like or reply. And if you value the content shared here every week, consider pledging your support. Thanks!

Find me on X or Bluesky for bite-sized opinions.

Until next time!

An amazing summary of what truly has been going on in Greece. Great quality and fact based reporting. You are amazing. Scary to see last weekend the same scenario of instability growing fast in Greece.. I was considering a return (for a senior job in Greece) after a few decades abroad however I have now changed my mind for two reasons: 1. The political parties are still operating with the norms of Greek politics from the 80s.. conspiracy, bribery, lack of transparency etc.. and 2. The young generation are still keen to have a revolution of destruction and fire complaining for everything whilst they are not keen to work hard and change the overall state of the country (the 1). It’s sad but true.. we are still a developing Balkan country..

Superb summary,. Most recent commentators have been focusing on gdp growth and bond yields but the image is way more complex than this and you have unpacked a lot.