Welcome to the 43 awesome new readers who joined in the past week!

If you haven’t subscribed, join 2,674 smart, curious people interested in Changing Greece.

💸 Taxes in Greece (2024)

We always complain about taxes in Greece.

And for good reasons.

We have a notoriously complex tax system.

Tax laws change drastically with every new government — heck, they often change during the tenure of the same government too.

Emergency and one-off taxes end up becoming standard and permanent.

The Greek tax system ranks 28th out of 38 countries in the OECD, according to the International Tax Competitiveness Index.

That’s not a great picture. But, quite frankly, it’s not terrible either.

In fact, if we look at the details, Greece is somewhat of a peculiar case.

Today, I’d like to answer the following question: how do Greek taxes compare to the rest of Europe?

To answer this, we will dive into the latest data from Tax Foundation.

Personal Income Tax

Let’s start with the basics: income taxes paid by individuals.

Greece follows a progressive tax scale on personal income.

The top statutory personal income tax rate — i.e. the rate that applies to income in the highest tax bracket — is 44% and applies to any income above 40,000 euros.

Compared to the rest of Europe, Greece is somewhat in the middle when it comes to the top statutory personal income tax rate.

However, the highest tax bracket (40,000 euros) is also exceptionally low. Even if there are not personal tax cuts in view, Greece should probably shift the scale higher.

Corporate Income Tax

Corporate taxation in Greece is one area where we have seen the greatest improvement over the past 50 years.

Moving from punishingly high corporate tax rates in the 1980s way above the world average, we are now finally slightly below it.

When compared to other European countries, the combined statutory corporate taxation in Greece is still slightly above average, but the trajectory is positive.

Value Added Tax (VAT)

Greece has the 6th largest VAT rate in Europe (3rd if we only look at percentages).

The VAT rate in Greece is exceptionally high and one of the main reasons why we continue to have such a large shadow economy (we’ve talked about that here).

There are some exceptions (e.g. reduced rates for certain products/services or Greek islands affected by the migration crisis) but these are rare and few.

Unfortunately, not only does Greece boast one of the largest VAT rates, it also has one of the narrowest VAT bases in the OECD, covering only 37% of final consumption.

Something probably has to change here.

Capital Gains Tax

Greece has one of the lowest capital gains taxes in Europe.

Any income generated from stocks, shares or stakes in partnerships, government bonds and treasury bills or corporate bonds, financial derivatives is taxed at just 15%.

With such a low capital gains tax, we should be making it much easier for people to invest in financial instruments, especially those in the middle class and below.

Property Tax

Greece has one of the highest property taxes in Europe.

If we look at the property tax as share of private capital stock, we come third.

Property tax was historically not a big concern for Greeks. This is why most families traditionally invested their entire life savings into real estate.

This changed when the notorious Uniform Tax on the Ownership of Real Estate Property (ENFIA) was introduced at the peak of the crisis in 2014.

ENFIA completely changed the game, not only making it harder for the average Greek to hold property, but also destroying entire families who had to forfeit their own in order to pay the insurmountable new tax.

For those lucky enough never to have dealt with it, here is a summary of how ENFIA works in practice:

The ownership of real estate property/property rights in Greece is subject to the ENFIA, which consists of a principal tax imposed on each real estate property and a supplementary tax imposed on the total value of the property rights on real estate property of the taxpayer subject to tax.

More specifically, said tax is not imposed on the objective value of real estate property, but is determined on the basis of various factors, according to the final registration of the property at the land registry or ownership title.

The principal tax on buildings is calculated by multiplying the square metres of the building by the principal tax ranging from EUR 2 to EUR 16.20 per square metre and other coefficients affecting the value of the property (e.g. location, use).

The principal tax on land is calculated by multiplying the square metres of the land by the principal tax ranging from EUR 0.0037 to EUR 9.2500 per square metre and other coefficients affecting the value of the property (e.g. location, use).

The supplementary tax on individuals is imposed at a progressive tax rate ranging from 0.15% to 1.15% and provides for a tax free amount of EUR 250,000 of the total value of property rights subject to ENFIA, including the value of plots outside urban planning (agricultural plots). Moreover, the value of property rights on buildings (including a potential analogy on the plots on which they are built) that have been characterised as maintained monuments or works of art and that have been built prior to the last 100 years is excluded.

Τhe supplementary tax on individuals was abolished by the provisions of L. 4916/2022 for the year 2022 onwards and replaced by an increase of the principal tax ranging from 5% to 20% according to the total value of the immovable property if it exceeds EUR 500,000.

Not fun.

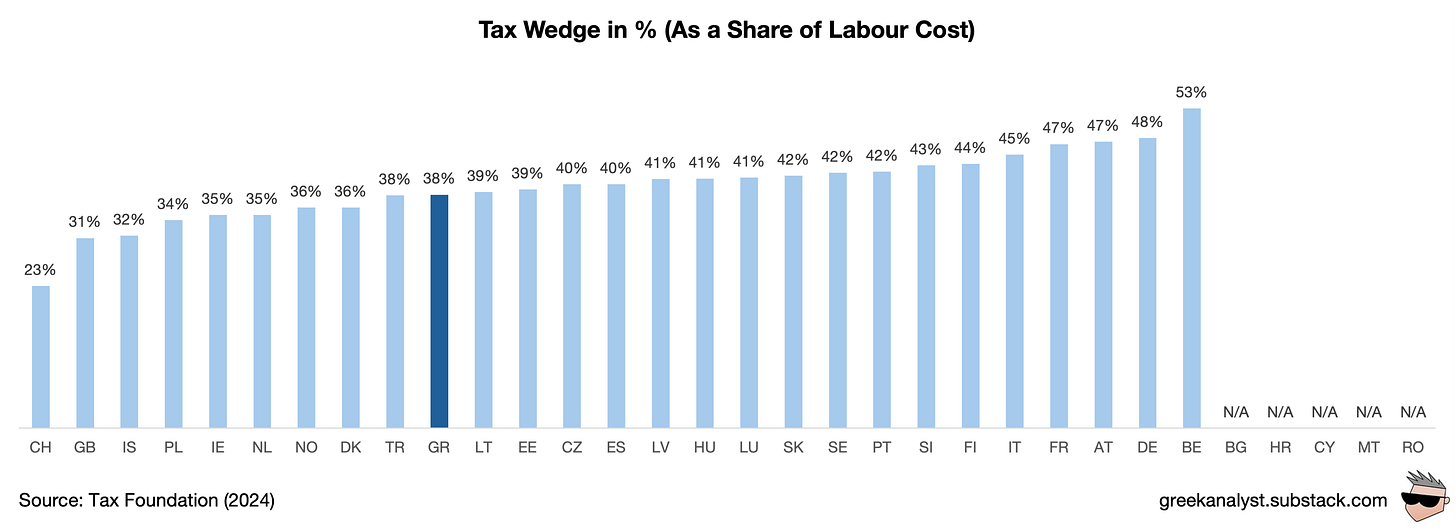

Tax Burden on Labour

The tax burden on labour (also known as the “tax wedge”) is the difference between an employer’s total cost of an employee and the employee’s net disposable income.

Let’s look at the example of an employee costing $45,000 in total for an employer in Greece (that is €41,000 per year).

The net after-tax income of that employee would be $28,500 (that is €26,200 per year).

That’s not very high.

Interestingly, Greece ranks below average in terms of its tax wedge across Europe.

Much more can be done here. The greatest offender is (still) the very high level of employer taxes and social security contributions that need to be further reduced.

Dividend Tax

Greece has the one of the lowest dividend taxes in Europe.

The takeaway here is simple: it’s great to be a shareholder in Greece.

Gas/Diesel Tax

Greece has the third highest gas tax (per liter) in Europe.

Thankfully, it has a much more balanced diesel tax (per liter).

If you (do not) own a diesel car in Greece, you probably feel the difference in your pocket every time you visit a gas station.

Summary

The tax situation in Greece is far from perfect but more mixed than many of us think and with clear improvements over the past few years.

Greek taxes oscillate between both positive and negative extremes compared to the rest of Europe.

Taxes are friendly for investors and shareholders, but still have some way to go for salaried employees and corporations. VAT is still unreasonably high.

In order to achieve equitable and sustainable growth for the long-term, Greece will need to continue cutting taxes to reach a better natural equilibrium.

🏭 Economy & Business

Scope explains its Positive Outlook on Greece’s credit rating

Unemployment rate falls to 9.3% in September 2024

Greek 10Y bonds reach pre-crisis levels on their yields

KEPE sees positive signals but also clear risks for the economy

Mitsotakis promises cuts on both VAT and income taxes by 2027

Handelsblatt writes about Greece’s impressive economic rebound

Cosmote will be investing €3B in fiber optic infra by end of 2027

Win Medica will invest €40M to create production facility at Tripoli

🤖 Tech & Startups

Pantheon AI (architecture AI) raises $25M, comes off stealth

Dyania Health (patient review AI) raises $10M in Series A

EVO (bioengineering & human performance) raised €1.2M

Indeex (digital transformation for industry ) raised €1M

Stock option policy in Greece ranks highly vs rest of Europe

Space startups created by Greek founders are multiplying

BigPi on why the field of robotics is set to shape our future

EIC will invest €1.4 billion in deep tech and scale ups in 2025

🙌 Celebrating Greek wins

Thanasis Valtinos (in Memoriam) was one the greatest Greek writers

NTUA team wins 3rd place at the AIChE ChemECar competition

📌 Spotlight: A glimpse at the Greek labour market

The balance of Hirings/Departures in the Greek labour market for Q1 of 2024 was the highest since 2001 — that is a 24-year record.

During the first six months of 2024, more than 339k new salaried jobs were created.

While there is a lot of variability across sectors, the Greek labour market is still hot.

That’s it for this week. I always love hearing from you. Make sure to hit that reply button.

Find me on X or Bluesky for bite-sized opinions.

Until next time!

Greece is a tax heaven for us the rich. Let them eat cake. (What a disgrace)

Also bonuses are taxed at income tax rate.

TL;DR you work hard, you are rich, you need to pay for everything. You are capital and passive? Attaboy!

Greece is at the moment tax advantageous for the wealthy . And wealthy foreigners are coming to take advantage of the very low dividends tax . Not justified when the low income people both self employed and employees are taxed to the bone .

I would advocate for a fair wealth tax like in Switzerland and other countries to balance Greece s growing and unsustainable equalities . Greek taxes hinder growth and pander to inherited wealth amongs other failings .

And one thing that someone should communicate to AADE : there is no verification of the foreign tax resident status by the system . Thefrefore, people who years ago were forreign residents but now live in Greece , are not taxed as Greek residents , they are not taxed anywhere in many cases..

Why is this happening , for Greek residents are required to evidence their tax clearance all the time ??