The Greek manufacturing sector

A deep dive into one of Greece’s most important industries

Welcome to the 50 awesome new folks who joined in the past few weeks! If you have not subscribed yet, consider joining 2,137 smart, curious people interested in Changing Greece.

🏭 The Greek manufacturing sector

Greece was never known for its manufacturing prowess.

The country’s geography — many rugged areas and mountains in the mainland, thousands of islands and small islets scattered around it — certainly did not help.

Historically, Greeks have been better known as excellent seafarers or great tradesmen. Our contemporary focus in the retail industry and service sector (mainly tourism) is probably not a coincidence.

But manufacturing is important and a key part of any dynamic industrial economy.

Unfortunately, with the exception of a high-growth spurt in the post WWII era, manufacturing never really picked up in the country. Even before the recent financial crisis, the manufacturing sector was in rapid and continuous decline.

For decades, Greece has been losing considerable ground to its EU peers as well as in the global markets. But recently, something interesting started happening.

Greek manufacturing has started to pick up. And it’s not just a dead cat bounce.

Greece’s manufacturing sector has been exhibiting a palpable recovery.

You don’t believe me? Let’s go through some of the most important numbers.

Manufacturing Production Index at 15 year high

The Greek Overall Industrial Production Index (IPI) reached in 2023 a 14-year high (121.5). While still far from its pre-crisis average, this is the highest reading since 2009 (122.6) with a trend that has been consistently positive since the bottom in 2014/2015.

The trend is even more positive for the Manufacturing IPI. The index not only hit a 15-year high (129.0) in 2023 (last highest reading was 131.9 in 2008); in the last 5 years it is also consistently trending above the Overall IPI for the first time since 2000.

The financial crisis was no joke. It decimated Greece’s industrial output and led to the closure of many factories and manufacturing companies in the country.

However, there are a number of industries that have started to see a gradual recovery

A few notable examples of recovering industries: Food, tobacco, paper, chemicals, rubber, computer and electronics, electrical equipment, and machinery.

And three remarkable exceptions: coke and refined petroleum products, basic metals and pharmaceuticals — all defied the crisis coming out much stronger on the other end of it.

Key manufacturing health indicators hit 13 year highs

The indices of Persons Employed, Hours Worked and Gross Wages and Salaries in Greek manufacturing have all hit 13 year record highs.

These are all key indicators that show the manufacturing industry has come a long way since the start of the crisis and seeing its human element improve.

Sales of manufactured products doubled in the last decade

The value of sales of manufactured products in Greece has doubled from €33 billion in 2010 to €66 billion in 2022.

Even if we factor in the impact of high inflation for 2021 and 2022, the trend remains positive and illustrates the impressive growth of Greece’s manufacturing industry.

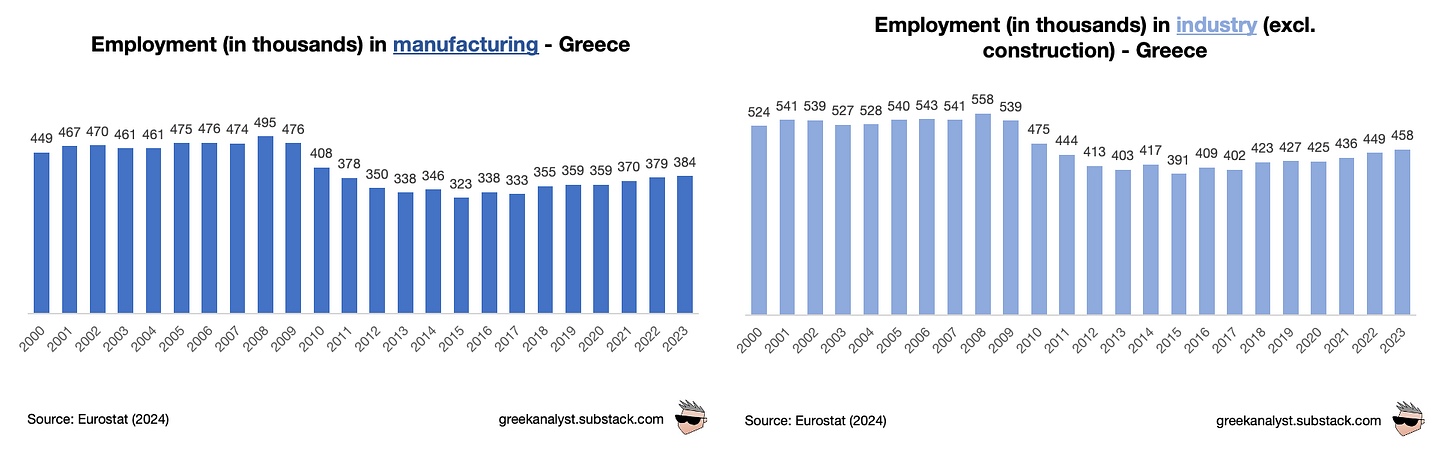

Employment in manufacturing hits 14 year high

The manufacturing sector and the broader industrial category in Greece saw a big dip in employment numbers after the crisis.

Manufacturing went from a top of 495K jobs in 2008 to a bottom of 323 jobs in 2015. Industry had 558K jobs in 2008 and only 391K in 2015.

In 2023, both manufacturing (384K) and industry (458K) saw the greatest number of employees since 2010 — another 14 year record. The trend is gradual but positive.

However, if we only narrow down on the high- and medium-high tech domain, we see a much more modest uptick and a consistently large gap with the EU average.

This is an area we need to invest much more in, ensuring we can create more skilled workers that operate at the forefront of innovation and high-end manufacturing.

Manufacturing exports (as % of GDP) tripled since crisis

In 2009, exports of manufacturing goods as % of GDP accounted for only 4.9% of Greece’s GDP. In 2022, that number has almost tripled, reaching 14.1%.

Exports of Greek manufactured goods continue to rise steadily every year. Sadly, we are still far behind from other comparable countries in Europe.

A concentrated effort is required to help the Greek manufacturing sector export more and higher-value goods abroad.

Manufacturing gross value is going up, but lagging vs EU

Gross Value Added (GVA) from manufacturing is inches away from its pre-crisis peak.

GVA as % of GDP reached a 20 year high in 2022 (bottom left chart), but is sadly trailing far behind the EU average (bottom right chart).

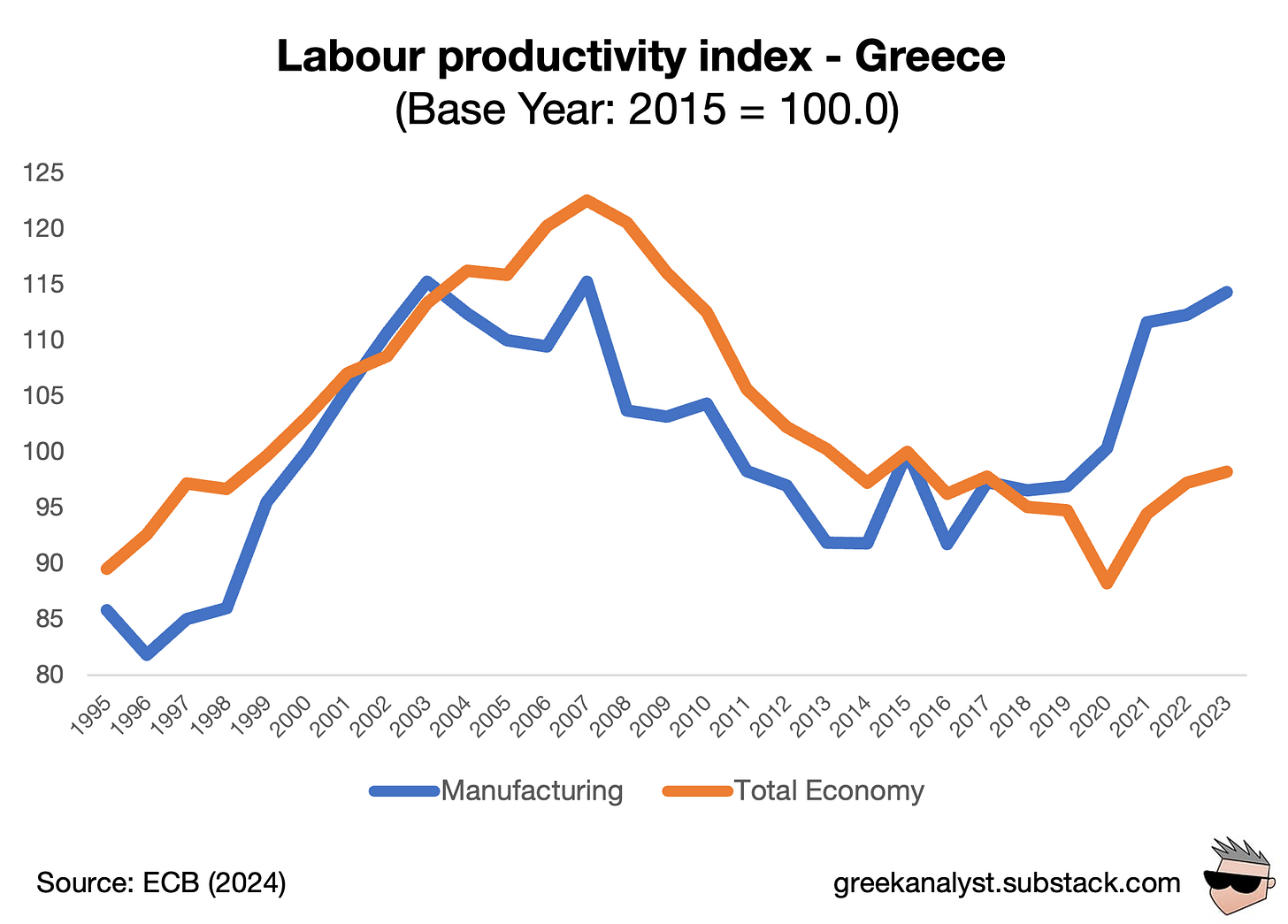

Labour productivity in manufacturing at pre-crisis peak

Labour productivity in Greek manufacturing has consistently outperformed labour productivity in the total economy since 2019 — by a very wide margin.

In 2023, the labour productivity index reached the same levels as its pre-crisis peak. Greek manufacturers are definitely doing something right.

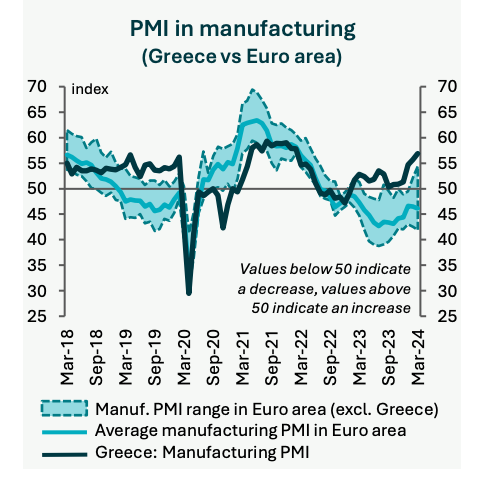

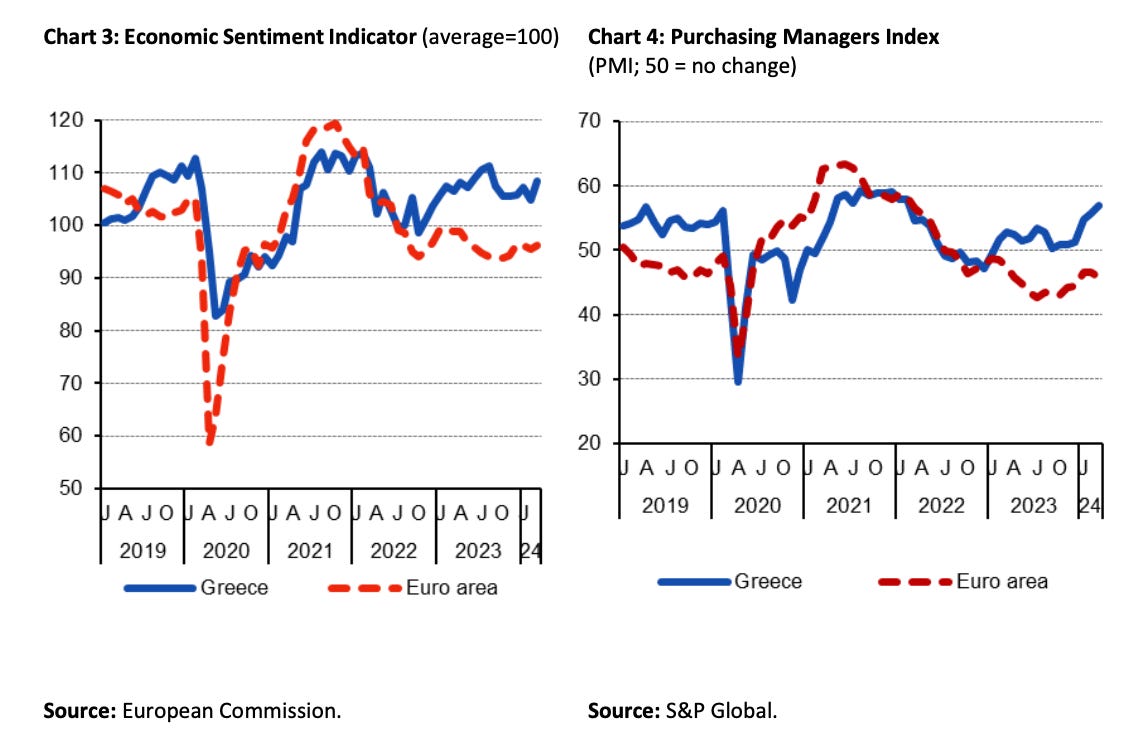

Manufacturing PMI sentiment on the rise

The manufacturing Purchasing Managers Index (PMI) surged to a 2-year high of 56.9 in March 2024, remaining the highest in the Euro area for a 15th consecutive month.

Both the Economic Sentiment Indicator (ESI) and the overall economy PMI remain significantly higher in Greece than the Euro area average — for more than a year now.

This creates an environment of unusually positive conditions for Greece, both from an investing and operating perspective.

Manifesting the Greek manufacturing miracle

Greece is faced with a unique opportunity.

For the first time since forever, the broad macroeconomic indicators for the Greek manufacturing industry look really strong. But the question remains — how durable is this recovery and how can we ensure it creates a strong industrial path for the future?

First, we need to elevate the idea of Hellenic production — i.e. manufacturing made in Greece. This needs to become a top priority for Greek policymakers.

Second, we need to listen to and invest in our domestic manufacturers. They face many obstacles and a constant uphill battle with little (if any) support from the state. This needs to change drastically, especially at a time when European industry is dying.

Third, we need to invest in smart manufacturing and robotics. Many projects have already started receiving funding thanks to RRF funds and we have started seeing a few noteworthy examples of new solutions, but we need to do much more.

Fourth, we need to connect our universities with industry. This means providing them with both the resources and pathways to collaborate and contribute to manufacturing. We need to make factories sexy again, but with a modern twist. Some great examples of research/scientific bodies already doing that are the Manufacturing Technology Lab (NTUA), the Hephaestus Smart Manufacturing Cluster (UPatras) and the Production Systems Laboratories (TUC).

Finally, we need more innovation. Domestic leaders like Gizelis are crucial for this, as they help expand the local sphere of possibilities. But we also need to catalyze new solutions (products, processes, tools) developed abroad. Here too, we are lucky — you see, Greek-founded companies like iCOMAT, KEWAZO and REEKON are already ushering the future outside of Greece. Why not bring them inside too?

In a globally competitive environment, there will be no Deus ex machina to help manifest the Greek manufacturing miracle. We already see that as large multinational firms are closing factories in Greece and abroad due to difficult market dynamics.

This is really up to us. But can we actually do this?

We have no other choice but to try.

💰 Raises & Exits

Blueground officially joins the unicorn club (>$1bn valuation).

Aeovian Pharmaceuticals (biotech) closed $50M in Series A.

DeepCure (biotech) raised $24.4M Series A1.

Proxy Foods (f&b) raised $2.3M seed.

CaptainBook raising $2.1M in fresh funding.

Expected Parrot (AI social science) announced its pre-seed.

Messium (agritech) raised $1.7M pre-seed.

CollegeLink (recruitment) raised €0.4M seed.

Orbito Travel (travel) raised €0.1M pre-seed.

🤖 Tech & Startups

Positive signs in the Greek tech ecosystem, according to Sifted.

Talent Visa and Tech Visa are introduced in Greece. Speed is of essence.

Dual-use technologies finally enter common parlance in Greece.

Coolset opens hub in Athens, aims for a 10+ team by 2025.

TileDB highlighted by NYSE in a floor talk with the startup's founder.

Even regulation falls victim to narratives, writes Konstantinos Gkovedaros.

🏭 Economy & Business

Investing in infrastructure is key to Greece's growth, argues Eurobank Research.

Greek retail trade keeps going up, according to latest ELSTAT figures.

Chemicals industry growing, posing risks but also opportunities for Greece.

EIB investment survey for Greece (2023) is out. A report full of great data.

Greek exports expected to rise, according to 70% of Greek companies.

New funds, more deals catalyzed by HDBI.

🙌 Celebrating Greek wins

Nikos Aliagas was master of ceremonies for lighting the Olympic flame in Greece.

Michael Bletsas becomes Director of the National Cybersecurity Authority.

Tonia Pontiki’s work on creating artificial ribs for cancer patients gets recognized.

Christos Masouros named IEEE Fellow for his work on joint sensing & comms.

🤯 Did you know?

Sharing is caring. If you’re thinking about starting something new, raising fresh funding, finding local talent, or investing in Greece, please reach out.

I get daily inbound from top builders, investors, scientists and professionals exploring opportunities in Greece. I love connecting great people together. There is no catch, no fees, and no expectations.

So… don’t be shy in hitting that reply button!

If you find this newsletter valuable, share it with a friend, and consider subscribing if you haven’t already. Until next time!

We will soon be producing more renewable energy than what we can use and sell.. turning this energy into a hydro production fuel is what many developing countries across the world are investing in. Turn renewable excess that is not possible to store into the fuel to produce easily storable and resealable hydrogen.. then sell hydrogen and build the first and leading hydrogen engines industry in Europe..

https://www.linkedin.com/feed/update/urn:li:activity:7188876755284148224/

Μια πολύ ενδιαφέρουσα και τεκμηριωμένη ανάλυση του κλάδου της μεταποίησης και παραγωγής, που θεωρώ κάθε ελληνική μεταφορική, διαμεταφορική και logistics εταιρεία πρέπει να μελετήσει προσεκτικά, γιατί ο κλάδος είναι βασικός πελάτης για μεταφορά, διανομή και αποθήκευση (αλλά και πολλές άλλες υπηρεσίες που μια 3PL πρέπει να προσφέρει).

Μερικά βασικά σημεία που αξίζει να προσέξουμε:

- Οι πωλήσεις προϊόντων που παράχθηκαν το 22 ξεπέρασε τα 66 δις ευρώ (σημειωτέον ότι το 2020 ήταν 37 δις),

- Οι εξαγωγές made in Greece προϊόντων, ως ποσοστό του ΑΕΠ έφτασε το 14% (νέο ρεκόρ!)

- Η παραγωγικότητα των εργαζομένων στον κλάδο ξεπέρασε το μέσο όρο της χώρας κατά 20 ποσοστιαίες μονάδες (πολύ ψηλότερα απο τον κλάδο των logistics, ίσως γιατί επένδυσαν σε νέες τεχνολογίες, νέους επιστήμονες, στον μετασχηματισμό της παραγωγικής του διαδικασίας και στην εκπαίδευση του προσωπικού τους--ίσως και να βοήθησε και το RRF!),

- Η προστιθέμενη αξία (Gross Value Added) του κλάδου επίσης πολύ εντυπωσιακή αφού έφτασε τα 20 δις ευρώ!! (9% του ΑΕΠ που είναι ρεκόρ 25ετίας)

Ο κλάδος των logistics μπορεί (και πρέπει) να ακολουθήσει με νέες εξειδικευμένες υπηρεσίες σε manufacturing logistics που απευθύνονται σε αυτές ειδικά τις παραγωγικές εταιρείες, που όμως σημαίνει ότι πρέπει να επενδύσουν σε εξειδικευμένο προσωπικό, νέες τεχνολογίες, "listen to & invest in" νεες υπηρεσίες. Για να πείσουμε τον κλάδο αυτό να μας εμπιστευτεί τα logistics του (outsourcing) δεν μπορούμε να περιοριζόμαστε στο να πουλάμε μόνο μεταφορά και αποθήκη...